Automated Invoice Software Roundup: Get Paid Without the Headache

- Andrew Leger

Goodbye Manual Invoicing, Hello Automation¶

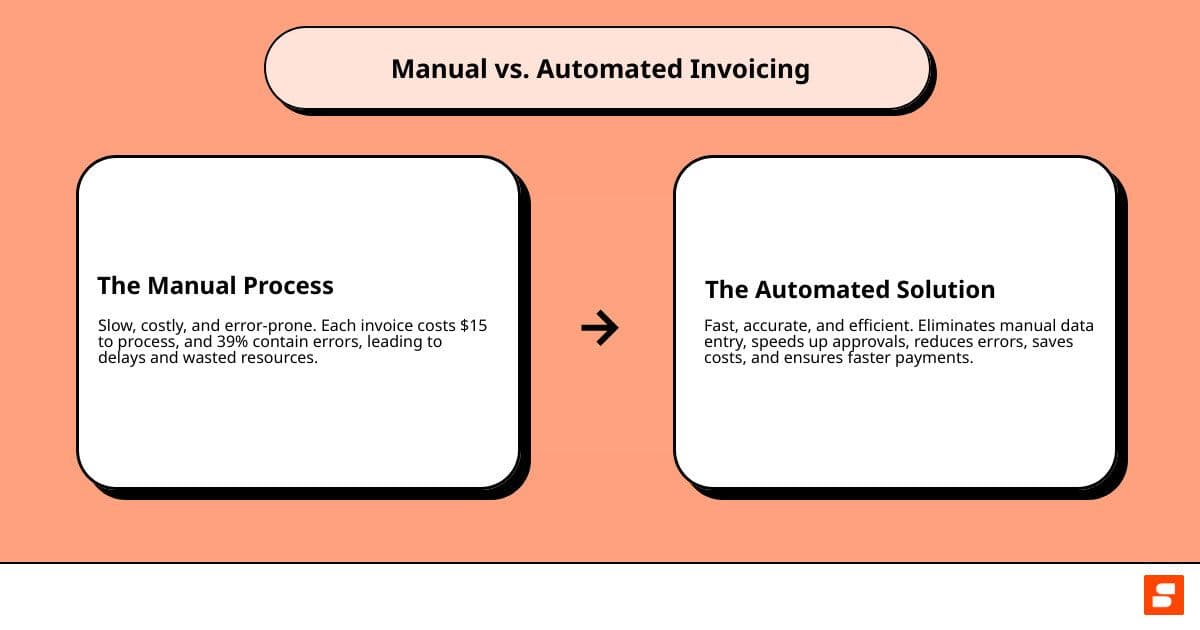

Looking to streamline your invoicing? Automated invoice software transforms how your business handles payments by eliminating manual data entry, speeding up approvals, reducing costly errors, and saving time and money. The ultimate goal: getting paid faster.

Many businesses spend countless hours processing invoices and chasing payments. This manual work is a major drain on resources. The average manual invoice costs $15 to process, and a staggering 39% contain errors. Automated invoice software converts this slow, error-prone chore into a smooth, efficient process, giving you valuable time back and boosting your bottom line.

I'm Andrew Leger, a software engineering leader with over 15 years of experience building enterprise-grade systems. My background in developing robust platforms has given me a deep understanding of how effective automated invoice software can revolutionize business operations, especially for field service companies.

Terms related to automated invoice software:

automated accounts receivable system

automated bookkeeping services

automated business process workflow

What is Invoice Automation and Why Ditch Manual Processing?¶

Feeling like your business is drowning in paperwork? Invoice automation is the modern solution. It uses smart technology to handle your invoices from arrival until payment, upgrading your entire process from slow and manual to fast and digital.

When an invoice arrives, automated invoice software uses technology like Optical Character Recognition (OCR) to "read" and extract key details: sender, invoice number, amount, and due date. This data is then validated against your records, like purchase orders, to ensure accuracy. From there, it moves through your pre-set approval workflow. Once approved, the system can schedule and execute the payment, often integrating seamlessly with your accounting or Enterprise Resource Planning (ERP) software.

Manual invoice processing is a financial headache. The average cost to process one invoice manually is around $15 , and a shocking 39% of them contain errors . These mistakes can lead to late payments, duplicate payments, or even fraud. With 56% of teams spending over 10 hours weekly on invoicing , it's clear that manual methods are a huge drain on time and resources.

If you’re curious about how these automated processes can streamline more than just invoices, check out our insights on Automated Business Process Workflow.

The High Cost of Sticking with Spreadsheets¶

Using spreadsheets or paper files for invoicing is slow, inefficient, and full of hidden costs. A major pain point is late payments—an astonishing 61% of late payments in the US happen because of invoicing errors . This ties up your cash flow due to preventable mistakes.

Manual systems introduce several other costly problems:

Inefficiency: Manual data entry and chasing approvals create bottlenecks, pulling your team away from revenue-generating tasks.

Lack of Visibility: It's nearly impossible to get a clear, real-time picture of your finances, making it difficult to forecast cash flow accurately.

Fraud Risk: Without automated checks and balances, it’s much easier for fraudulent invoices to slip through, costing your business a fortune.

Scalability Issues: As your business grows, a manual system can’t keep up without hiring more staff, which is expensive and unsustainable.

How Automated Invoice Software Works¶

So, how does automated invoice software turn chaos into an efficient operation? It uses a systematic, tech-driven approach at every stage.

Invoice Capture: Invoices are automatically pulled from emails, scanned paper documents, or ingested directly as e-invoices (e.g., XML files).

Data Extraction & Validation: Using OCR and AI, the software "reads" the invoice, extracts key information, and validates it against your vendor lists and other records. Some systems boast up to a 96% accuracy rate.

2/3-Way Matching: The system automatically matches the invoice against the corresponding purchase order (PO) and, if applicable, the goods receipt. Discrepancies are flagged for human review.

Approval Routing: Based on pre-set rules (like amount or department), the invoice is automatically sent to the right person for approval, who can approve it from any device.

Payment Scheduling & Execution: Once approved, the system schedules the payment according to your terms and can initiate payments via ACH, credit card, or other methods.

System Integration: The software connects with your existing accounting or ERP systems (like QuickBooks, Xero, or Sage Intacct), ensuring all financial data is synchronized and accurate. This streamlined process can eliminate up to 98% of manual work and save 82% of time on validation.

Key Benefits of an Automated Invoice Platform¶

Adopting an automated invoice platform open ups a new level of efficiency, cost savings, and financial clarity. It's like upgrading from a flip phone to a smartphone—everything just works better, faster, and smarter.

Automating your invoicing leads to faster approvals and a dramatic drop in errors and duplicate payments. This improves vendor relationships, as timely payments build trust and can lead to better terms. You'll also gain improved visibility into your finances with real-time insights for better cash flow management.

The benefits extend to greater cost savings by avoiding late fees and capturing early payment discounts. Your data is more secure with increased data security and cloud-based storage. As your business grows, the software's significant scalability handles increased invoice volume without needing more staff.

For a deeper dive, explore our insights on Automated Billing Platform.

Slash Costs and Boost Efficiency¶

Let's talk about the bottom line. The cost difference between manual and automated invoicing is eye-opening. According to IOFM metrics :

Low-performing companies with manual processes pay around $6.20 per invoice.

Top-performing companies with full automation can lower that cost to just $1.45 per invoice.

These tangible savings come from reduced manual labor. With 56% of teams spending over 10 hours weekly on invoicing , automation frees your staff from tedious data entry. They can then shift their focus to higher-value activities like financial analysis, strategic planning, and strengthening vendor relationships.

To learn more about freeing up your team, see our resources on Automated Bookkeeping Services.

Improve Cash Flow and Business Relationships¶

Automated invoice software turbocharges your cash flow. Automated reminders gently nudge clients about upcoming or overdue payments, eliminating awkward follow-up calls. This dramatically reduces payment cycles, getting money into your bank account much faster. Many solutions offer customer payment portals, making it convenient for clients to pay online, which can lead to payments being received twice as fast.

Faster payments lead to improved supplier satisfaction. Consistently paying vendors on time makes you a preferred customer, opening the door to better pricing and stronger partnerships. To achieve this financial harmony, an Automated Accounts Receivable System is essential.

2024 Roundup: Top Automated Invoice Software Solutions¶

Ready to dive into automated invoice software? There's a solution for nearly every business, from freelancers to large enterprises. These tools are designed to make your invoicing life smoother and faster. We've rounded up some leading contenders to help you find your match.

Solution

Target User

Pricing Model

Key Feature

Mobile App Availability

Zoho Invoice

Freelancers, SMBs

Free forever

Mini-CRM, extensive free features

Yes (iOS, Android, desktop)

Wave

Freelancers, Small Service Businesses

Free (invoicing/accounting), Pay-per-use payments

Integrated accounting, mobile invoicing

Yes (iOS, Android)

QuickBooks Online

Growing SMBs, Accountants

Subscription-based

Comprehensive accounting, large integrations

Yes (iOS, Android)

Jobber

Small-to-Mid Field Service Businesses

Subscription-based

User-friendly, estimate-to-invoice automation

Yes (iOS, Android)

Housecall Pro

US Field Service Businesses

Subscription-based

Strong marketing tools, all-in-one management

Yes (iOS, Android)

ServiceTitan

Large Field Service Businesses

Custom, subscription-based

Advanced reporting, premium features

Yes (iOS, Android)

Rossum

Mid-market, Enterprise (high volume AP)

Custom, volume-based

AI-powered document processing, high accuracy

N/A (web-based for AP teams)

Best for Freelancers and Small Businesses¶

If you're a freelancer or small business, you need software that's easy to use, affordable, and helps you get paid without fuss. Zoho Invoice is a standout because it's completely free, offering unlimited invoices and customers. It’s packed with features like customizable templates, multi-currency support, and even mini-CRM capabilities. Another excellent free option is Wave, which offers free invoicing and accounting, charging only for online payment processing. Its professional templates and automated reminders are ideal for service-based businesses.

For those who track time for projects, FreshBooks is a strong contender. It excels at time-tracking and project-based billing, with a user-friendly interface that simplifies invoice creation and expense tracking. Other popular choices include Invoice Ninja, PayPal Invoicing, and Square Invoices, each offering unique features for freelancers and small businesses.

Best for Growing Businesses and E-commerce¶

As your business grows, your invoicing needs become more complex. You need robust reporting, more integrations, and the ability to handle higher transaction volumes.

QuickBooks Online is a powerhouse in small business accounting, offering a comprehensive suite of tools beyond invoicing, including payroll, inventory management, and powerful reporting. Its vast integration marketplace makes it incredibly flexible. Xero is another popular choice, loved for its intuitive cloud-native interface, strong bank reconciliation, and unlimited user access, making it great for collaboration. For businesses focused on automating the entire invoice-to-cash process, BILL (formerly Bill.com) specializes in advanced AP/AR automation with sophisticated approval workflows and international payments.

Best for Field Service Businesses¶

For businesses in the field service industry, such as HVAC, plumbing, or lawn care, specialized software that integrates invoicing with job management is essential. These all-in-one platforms cater to the unique workflows of mobile teams.

Jobber: A prominent choice for small to mid-sized service businesses, Jobber offers a user-friendly platform with robust features for quoting, scheduling, dispatching, and invoicing. Its automated follow-ups and client hub with online payments are particularly strong for improving cash flow.

Housecall Pro: Another leader in the space, Housecall Pro is known for its strong marketing tools, such as automated email campaigns and postcard mailers, in addition to core field service management features. It helps businesses not only manage jobs but also grow their customer base.

ServiceTitan: Geared more towards larger residential and commercial service businesses, ServiceTitan is a comprehensive platform with advanced reporting, call booking, and marketing automation features. It's a powerful, albeit more complex, solution for companies looking to scale significantly.

Best for Mid-Market and Enterprise¶

For larger organizations with high invoice volumes and complex compliance needs, invoicing software must integrate deeply with broader financial systems. These solutions offer advanced controls and scalability.

Sage Intacct is a powerful ERP accounting software endorsed by the AICPA, built for growing and mid-sized businesses. It excels at multi-entity management and advanced financial reporting. For companies processing vast numbers of documents, Rossum uses AI-powered document processing for intelligent data extraction, boasting impressive accuracy rates. Other enterprise-level solutions like Tipalti and SAP Concur offer global payables automation and integrated expense management, respectively, to handle the complexities of large-scale operations.

Essential Features to Look For¶

When choosing automated invoice software, it's easy to feel overwhelmed. To help, we've created a guide to the must-have features that will genuinely transform your invoicing process.

Core Invoicing and Billing Features¶

These are the fundamental building blocks for professional and efficient billing.

Customizable Templates: Add your logo and brand colors to create professional-looking invoices.

Recurring Invoices: Automate billing for regular clients, subscriptions, or retainers by setting up invoices to send at regular intervals.

Automatic Payment Scheduling: Schedule one-time payments or set up auto-charging for cards on file to ensure timely collection.

Multi-Currency Support: Bill international clients in their local currency to simplify transactions.

Tax Calculation: Automatically calculate the correct taxes to avoid common errors and save time.

Online Payment Gateways: Integrate with popular options like Stripe and PayPal to make it easy for clients to pay you quickly.

Expense Tracking: Log and categorize business expenses, and easily convert them into billable items on an invoice. Learn more with our Automated Expense Management Tools.

Time Tracking: Log billable hours directly within the software and convert them into accurate invoices.

Automation and Workflow Management¶

These features are what turn your software into an efficiency powerhouse.

Automated Payment Reminders: Set up automatic nudges for upcoming, due, and overdue invoices to end the follow-up chase.

Approval Workflows: Ensure invoices are reviewed and approved by the right people before payment, reducing fraud risk.

Client Portal: Give clients a secure place to view their invoice history and make payments online.

Real-time Status Tracking: Know the exact status of every invoice (sent, viewed, paid, overdue) at a glance for better cash flow visibility.

Data Sync with Accounting Systems: Ensure seamless integration with your accounting software (like QuickBooks or Xero) to maintain accurate, consistent financial data.

Reporting & Analytics: Gain insights into income, expenses, and payment trends to make smarter, data-driven business decisions.

Mobile Access: Create, send, and track invoices from your smartphone or tablet—a must for professionals on the go.

Frequently Asked Questions about Invoice Automation¶

It's natural to have questions when considering a switch to automation. Here are clear answers to some of the most common queries about automated invoice software.

What is the difference between AP automation and invoice automation?¶

Think of it this way: invoice automation focuses specifically on the lifecycle of an invoice—from receipt to payment and recording. It's a key component of the broader Accounts Payable (AP) automation.

AP automation covers the entire procure-to-pay workflow, including purchase orders, vendor management, expense reports, and payment reconciliation. In short, invoice automation is a specialized tool, while AP automation is the entire toolkit for managing payments to suppliers.

Can automated invoice software integrate with my existing accounting system?¶

Yes, absolutely. This is a critical feature. Most reputable platforms are designed to integrate with popular accounting or ERP systems like QuickBooks, Xero, Sage, and NetSuite. These connections happen in a few ways:

Native Integrations: Pre-built, "plug-and-play" connections for the smoothest experience.

API Access: A toolkit for developers to create custom connections to specialized or in-house systems.

Third-Party Connectors: Tools like Zapier can act as a bridge between your invoice software and thousands of other apps.

Always confirm a platform's integration capabilities with your current setup before committing.

How much does invoice automation really save?¶

The savings are substantial. While exact figures vary, the data is compelling. IOFM reports that top performers with full automation can reduce their cost to just $1.45 per invoice, compared to $6.20 per invoice for manual processing .

These savings come from several areas:

Reduced Labor Costs: Automation eliminates tedious manual tasks. Some AI-powered tools can eliminate up to 98% of manual work, freeing up your team for strategic activities.

Fewer Errors: Automated systems drastically reduce costly mistakes like duplicate payments or incorrect amounts.

No More Late Fees: Timely processing and payment scheduling help you avoid penalties from suppliers.

Early Payment Discounts: Automation helps you identify and capture discounts for paying invoices early.

Fraud Prevention: Features like 3-way matching and anomaly detection flag suspicious invoices, protecting your bottom line.

Conclusion: Stop Chasing Payments and Start Growing¶

We've covered how automated invoice software can transform your business. The takeaway is clear: the days of wrestling with manual invoices, frustrating errors, and chasing payments are over. Embracing automation is essential for any business that wants to thrive.

By automating, you gain significant time savings, slash costs, reduce errors, and improve cash flow. You also build stronger relationships with clients and suppliers. By letting software handle the tedious work, your team can focus on what truly drives your business forward: serving customers and pursuing growth. It turns a necessary chore into a competitive advantage.

For field service businesses in HVAC, plumbing, or lawn care, integrating invoicing with job management is a game-changer. You need a solution that's as mobile and efficient as you are. That’s why ServiceBuilder created a mobile-first platform specifically for U.S. field service pros.

We help you manage everything from quotes and scheduling to dispatch and, most importantly, getting paid—all from one easy-to-use platform. No bloated features or complex pricing, just what you need to succeed.

Ready to stop chasing payments and start growing? See how ServiceBuilder can streamline your entire operation. Visit us at ServiceBuilder and modernize your business without the fuss.