Why Automated Bookkeeping Services Are Your New Best Friend

- Andrew Leger

Why Automated Bookkeeping Services Are Game-Changers for Busy Business Owners¶

Automated bookkeeping services use AI and machine learning to handle your financial record-keeping with minimal manual input. Here's what you need to know:

What they do:

Auto-sync bank transactions and categorize expenses

Scan receipts using OCR technology

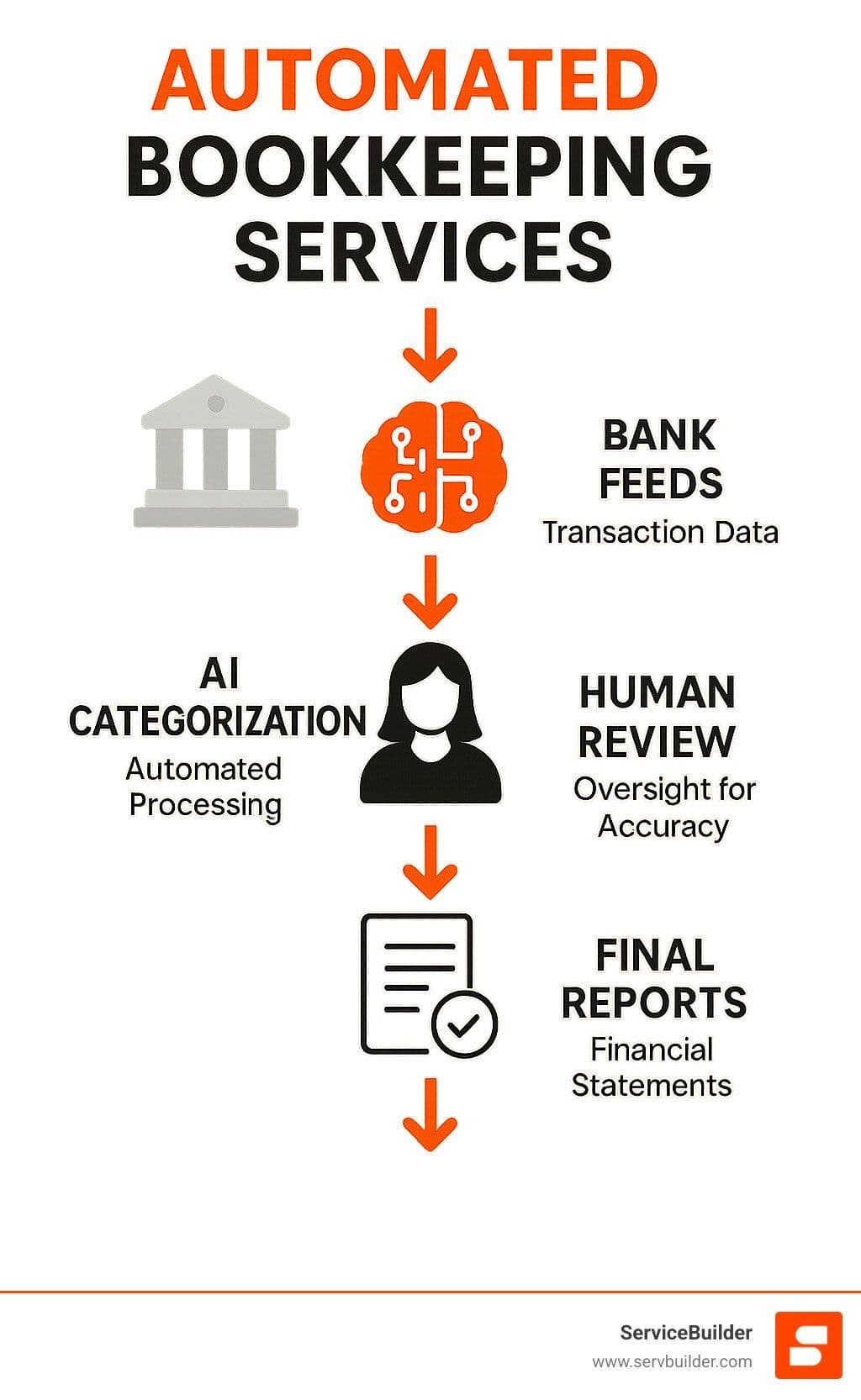

Generate real-time financial reports

Handle tax preparation and compliance

Provide human oversight for accuracy

Key benefits:

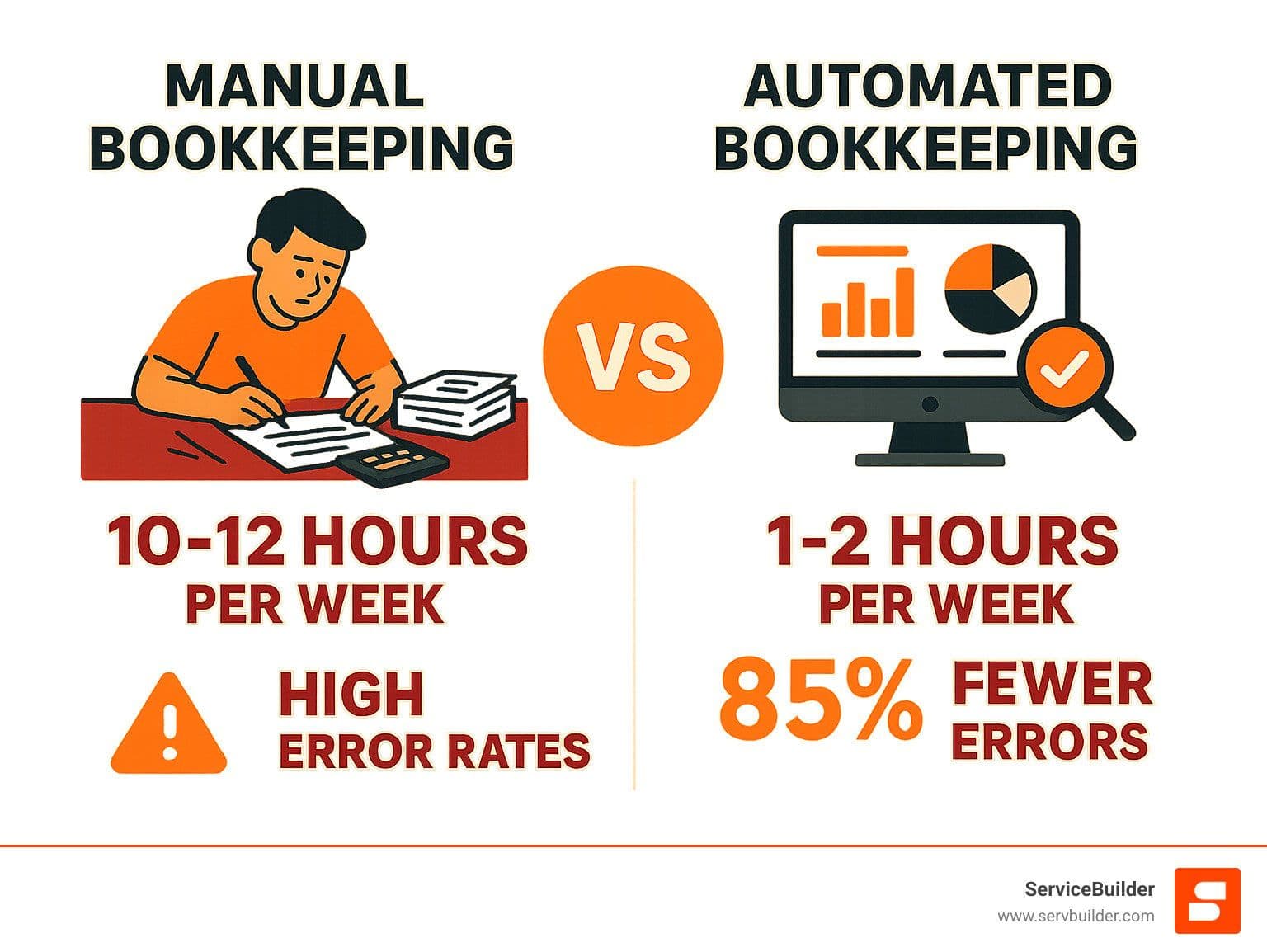

Save 10-12 hours per week on financial tasks

Reduce errors by up to 85% compared to manual entry

Real-time insights for better business decisions

Tax-ready books year-round

Popular options: QuickBooks Online, Xero, Bench, Zeni, Finally, Kick, and Nobooks

If you're running a service business and still wrestling with spreadsheets or manual data entry, you're not alone. The research shows that 8 out of 10 customers say automated bookkeeping saves them significant time, while 85% feel more confident about their financial accuracy.

The math is simple: every hour you spend on bookkeeping is an hour you're not growing your business, serving customers, or improving operations. Modern automated bookkeeping services handle the heavy lifting while you focus on what actually drives revenue.

I'm Andrew Leger, and after 15+ years building enterprise software systems, I've seen how the right automated bookkeeping services can transform operations for service businesses. At ServiceBuilder, we help field service companies integrate these financial tools with scheduling and dispatch systems for complete operational efficiency.

Understanding Automated Bookkeeping Services¶

Think of automated bookkeeping services as having a super-smart assistant who never sleeps, never makes math errors, and actually enjoys sorting through your receipts. These platforms combine AI technology with real human expertise to transform how businesses handle their finances.

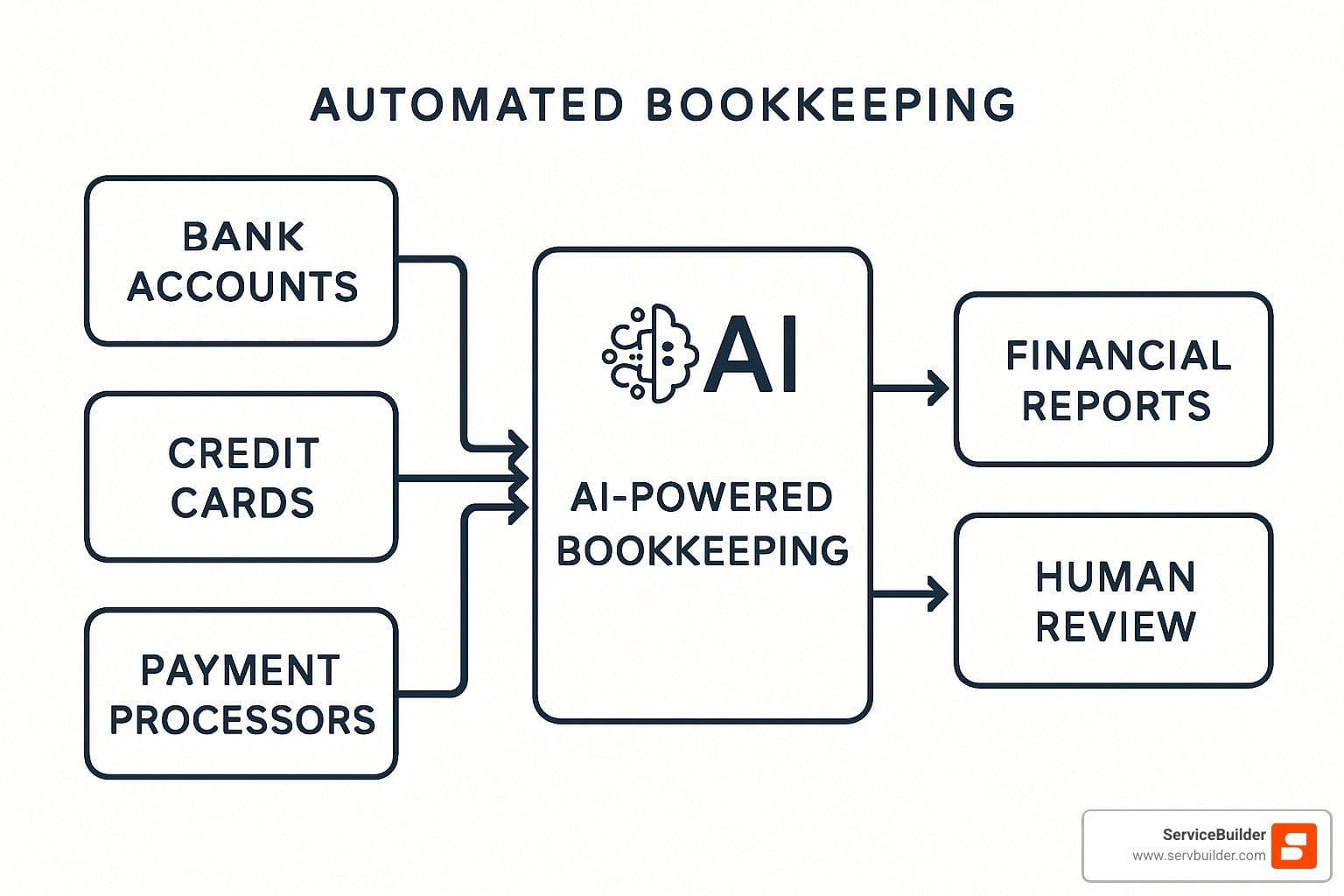

Sophisticated software connects directly to your bank accounts and credit cards, automatically pulling in every transaction as it happens. The system then uses machine learning to categorize each expense – whether that $89 charge is for office supplies or truck maintenance.

The key differentiator is human oversight. While AI handles the heavy lifting of data entry and categorization, experienced bookkeepers review everything to catch nuances that software might miss. The whole system follows GAAP standards, so you get professional-grade financial records that are tax-compliant.

How Automated Bookkeeping Services Work¶

The process starts with bank feeds that automatically sync your financial accounts. A smart rules engine begins learning your business patterns, remembering that charges from your local parts supplier always go to "Equipment & Supplies."

Receipt scanning uses OCR technology to read vendor names, amounts, dates, and purchase details from photos. The system then matches receipts to corresponding bank transactions automatically.

Real-time reconciliation happens continuously in the background. Your financial dashboards update instantly, so you always know exactly where your business stands financially.

Automated Bookkeeping Services vs. Traditional Bookkeeping¶

Traditional manual entry and spreadsheets require business owners to spend evenings typing numbers into accounting software. Double-entry bookkeeping requires recording every transaction twice, doubling both time and error potential.

Automated bookkeeping services flip this process upside down. Instead of you entering data, the system pulls it automatically. Instead of waiting weeks for financial reports, you get instant insights. The cost savings are remarkable – most businesses cut bookkeeping expenses by 50-70% while getting better, more timely financial information.

The Role of AI & ML in Automated Bookkeeping Services¶

Pattern recognition allows AI to learn that your $150 monthly charge from "ABC Software Solutions" is always a business software expense, while that $45 gas station charge is probably personal.

Predictive coding suggests categories for new transactions based on similar past expenses. Anomaly detection acts like built-in fraud protection, flagging unusual charges for review.

The continuous learning aspect means your system gets smarter every month. Zeni AI Bookkeeping processes over $1.3 billion in transactions monthly, with their AI improving categorization accuracy with every transaction.

Benefits and Limitations for Small Businesses & Solopreneurs¶

Running a small business or working as a solopreneur means wearing about fifteen different hats on any given day. You're the CEO, the sales team, customer service, and unfortunately, often the bookkeeper too. Automated bookkeeping services can finally let you take off that last hat and focus on what actually grows your business.

The change goes way beyond just saving time (though you'll definitely get those hours back). These platforms change your entire relationship with money management, turning financial stress into financial confidence.

Main Benefits of Automated Bookkeeping Services¶

The biggest win is getting your life back. When your books handle themselves, you can focus on core business activities that actually make you money. Instead of spending Sunday afternoons wrestling with receipts and spreadsheets, you're out there serving customers or planning your next growth move.

Cash flow clarity becomes your new superpower. No more guessing whether you can afford that new piece of equipment or wondering if you're profitable this month. Real-time dashboards show exactly where your money is - what's coming in, what's going out, and what's left over. It's like having x-ray vision for your finances.

Tax-ready books happen automatically all year long. Panic you feel every April when you realize you need to organize twelve months of financial chaos? That's gone. Your receipts are scanned, expenses are categorized, and everything is audit-ready whenever you need it.

Growth support means your financial system scales with you. Whether you're a one-person operation or you're expanding to multiple locations, automated platforms handle the increased complexity without requiring you to hire a full accounting department.

Potential Drawbacks & How to Mitigate Them¶

Let's be honest - no system is perfect, and automated bookkeeping services have their quirks. Software judgment limits mean the AI might get confused by unusual transactions or industry-specific situations. That weird deposit from your biggest client's parent company? The system might not know how to categorize it.

The good news is that most quality platforms solve this with human oversight - real bookkeepers who review the AI's work and catch these edge cases. It's like having a safety net that ensures accuracy while still saving you tons of time.

The setup learning curve can feel overwhelming at first. Connecting all your accounts, setting up rules, and learning new dashboards takes some effort upfront. But think of it like learning to use a smartphone - awkward for a week, then you can't imagine life without it.

Data quality matters more than ever. If you connect the wrong accounts or set up categories incorrectly, you'll get garbage results. The solution is taking the onboarding process seriously and working with platforms that offer solid support during setup.

Security & Accuracy Considerations¶

Your financial data is precious, and modern automated bookkeeping services treat it that way. Bank-level encryption, SOC-2 compliance, and two-factor authentication are standard features. Many platforms actually provide better security than keeping paper records in a filing cabinet or storing spreadsheets on your laptop.

Audit trails become incredibly detailed with automated systems. Every transaction, every change, every report gets logged with timestamps. If you ever face an audit or need to track down a discrepancy, you'll have a complete digital paper trail that's way more organized than any manual system.

The 99.9% accuracy rates that quality automated systems achieve blow manual bookkeeping out of the water. When you're tired and entering numbers at 11 PM, mistakes happen. AI doesn't get tired, doesn't transpose numbers, and doesn't forget to save files.

Human error in financial records can cost you money in missed deductions, incorrect tax filings, or poor business decisions based on bad data. Automated systems combined with professional oversight give you a level of reliability that's nearly impossible to achieve manually.

Choosing the Right Automated Bookkeeping Service¶

Finding the perfect automated bookkeeping services platform requires knowing what you're looking for before you start evaluating options. The market spans everything from basic automation tools to full-service financial management teams.

Platform

Auto-Categorization

Tax Prep

Human Support

Monthly Cost

Best For

QuickBooks Online

Excellent

Add-on

Limited

$30-200

Established businesses

Xero

Good

Third-party

Limited

$13-70

International/Multi-user

Bench

Good

Included

Full-service

$190-490

Hands-off approach

Zeni

Excellent

Included

Full team

Custom

High-growth startups

Finally

Good

Included

In-house team

Custom

All-in-one needs

Kick

Excellent

Included

Expert review

Custom

Multi-entity businesses

Nobooks

Basic

Included

SMS support

$120

Solopreneurs

Must-Have Features in Automated Bookkeeping Services¶

Bank synchronization is the foundation that makes everything else possible. Your platform needs to connect seamlessly with all major banks and credit card providers, importing transactions in real-time.

Receipt OCR technology should extract key details from photos and automatically match them to corresponding bank transactions. Mobile apps matter because the best receipt is captured immediately after purchase.

Customizable rules engines let you teach the system your business quirks. Multi-entity support becomes crucial as you grow, handling multiple locations or separate LLCs without breaking a sweat.

Platform Showdown: Leaders at a Glance¶

QuickBooks Online dominates the bookkeeping world, auto-categorizing over 550 million transactions annually with robust third-party integrations. The learning curve can feel steep, and costs add up quickly with additional features.

Xero excels in multi-user environments and international businesses, supporting unlimited users and over 160 currencies. Their bank reconciliation interface cleverly combines transaction matching and categorization.

Bench takes the "set it and forget it" approach, combining automated data entry with dedicated human bookkeepers. Over 35,000 small businesses trust them for complete bookkeeping management.

Finally offers a modern, all-in-one finance suite with AI-driven transaction classification and mobile-first design. Kick focuses on multi-entity businesses with unlimited entity support and expert review.

Nobooks targets solopreneurs with SMS-based bookkeeping requiring no apps - just text your expenses. Zeni combines AI bookkeeping with fractional CFO services for high-growth startups.

Pricing & Integration Considerations¶

Subscription models vary dramatically. Some charge flat monthly fees regardless of transaction volume, while others scale based on business size. Research shows that manual bookkeeping often costs more than automated solutions when factoring in time investment.

API connectivity becomes crucial for field service businesses. Direct integration with scheduling and dispatch software eliminates double data entry and ensures accurate job costing. The time saved on data synchronization often justifies higher monthly fees.

Real-World Impact & Success Stories¶

When you switch to automated bookkeeping services, you're investing in measurable improvements that show up in your bottom line and daily stress levels. Businesses consistently report saving 12 hours per week on financial tasks and achieving 44% revenue lifts through better decision-making.

Case Studies & Testimonials¶

An HVAC startup owner was drowning in weekend paperwork, trying to figure out which jobs made money. After implementing automated bookkeeping, he got those 12 hours back and finded his most profitable services weren't what he expected. Real-time job profitability data helped him raise prices on low-margin work.

A freelance designer experienced quarterly tax panic attacks, spending entire weekends sorting through shoe boxes of receipts. Now her automated system handles receipt scanning and categorization automatically. Tax season went from her worst nightmare to just another Tuesday.

A SaaS founder managing three business entities was spending 20+ hours monthly tracking intercompany transactions. His automated platform handles multi-entity reporting automatically, providing consolidated views and separate books without manual work.

A Kick user found $30K in savings in just 30 minutes by reviewing automated expense categorization. The system flagged dozens of forgotten recurring subscriptions and services - unused software licenses to redundant vendor contracts.

How Automated Bookkeeping Services Drive Better Decisions & Growth¶

Unit economics become visible for the first time. Every service call, project, and customer relationship becomes measurable. That HVAC owner finded emergency repair calls generated 3x the profit margin of routine maintenance - information that completely changed his marketing strategy.

Cash flow clarity transforms planning and growth decisions. Real-time dashboards show what's coming in, going out, and available for growth investments. Lender readiness becomes automatic with clean, GAAP-compliant records maintained year-round.

Getting Started: Transitioning to Automated Bookkeeping¶

Making the switch to automated bookkeeping services doesn't have to feel overwhelming. Most successful transitions happen over 30-60 days, giving you time to get comfortable while ensuring your financial data stays accurate.

More info about choosing FSM software offers valuable insights that apply to selecting financial software. Match the platform's capabilities to your specific business needs and growth plans.

Step-by-Step Migration Plan¶

Start with an honest assessment of your current bookkeeping process. Document how much time you spend, what frustrates you most, and what you need from a new system.

Choose your platform thoughtfully using free trials to test actual workflow with your real data. Connect your accounts gradually starting with your primary business checking account before adding credit cards and other payment sources.

Import your transaction history for context - most platforms can pull 12-24 months of past transactions. Set up categorization rules based on how you actually run your business, not generic chart of accounts.

Verify your starting balances by comparing your new system against old records. If opening balances are wrong, everything that follows will be off.

Human Oversight & Continuous Improvement¶

Plan to spend 30-60 minutes each month reviewing what your system has done. Look for miscategorized transactions, check for duplicates, and ensure everything looks reasonable.

Quarterly check-ins with a professional can catch issues before they become problems. KPI dashboards help monitor both business performance and system performance.

The transition requires patience, but most business owners find that after 60-90 days, their automated bookkeeping services feel natural and indispensable.

Frequently Asked Questions about Automated Bookkeeping Services¶

Let's tackle the most common questions I hear from service business owners who are considering making the switch to automated bookkeeping services.

What industries benefit most from automated bookkeeping services?¶

If you're running a service-based business, you're probably going to love what automation can do for your books. HVAC contractors, landscapers, cleaning services, and pest control companies see some of the biggest wins because they juggle tons of transactions, complex job costs, and usually don't have time to mess around with spreadsheets.

Think about it - when you're running between job sites all day, the last thing you want to do is come home and categorize receipts. Automated bookkeeping services handle all that busy work while you focus on what actually makes money.

Professional services like consultants, freelancers, and agencies get huge benefits too, especially when it comes to tracking time and seeing which projects are actually profitable. E-commerce businesses love the automated sales tax handling and how everything syncs up from different sales channels.

Here's the thing though - the more complex your business gets, the more automation helps. Multiple locations? Different business entities? Tons of expense categories? That's where these systems really shine and save you serious time.

How do these services handle tax preparation and compliance?¶

This is where automated bookkeeping services really prove their worth. Most of the comprehensive platforms either include tax prep or make it so much easier that your accountant will thank you.

Services like Bench, Zeni, and Finally actually handle your taxes from start to finish. They'll manage your quarterly payments, file your returns, and even give you tax advice throughout the year. It's like having a tax pro on your team without the full-time cost.

If you're using software-focused platforms like QuickBooks or Xero, they connect seamlessly with tax services or export clean data to your tax preparer. The real magic is having organized, accurate books all year long instead of that annual scramble to find receipts in your glove compartment.

The compliance stuff happens automatically too - 1099s get generated, sales tax gets calculated, and everything stays audit-ready. No more sleepless nights wondering if you missed something important.

How easy is it to integrate automated bookkeeping with my existing field-service software?¶

Great question, and honestly, this is where you need to be a bit picky about which platforms you choose. The good news is that most modern automated bookkeeping services play nice with field service software, but some are definitely better than others.

QuickBooks Online is probably your safest bet for integrations - it connects with pretty much every field service platform out there, including ServiceTitan, Jobber, and hundreds of others. When everything syncs automatically, your job costs, customer payments, and expenses all flow together without double data entry.

At ServiceBuilder, we built our platform specifically with this integration challenge in mind. Our API connects smoothly with major accounting platforms, so your scheduling, dispatching, and financial data stay perfectly synchronized. No more wondering if that job payment actually hit your books or if those material costs got recorded properly.

The key is choosing platforms that were designed to work together instead of trying to force incompatible systems to talk to each other. Look for pre-built connectors and strong API support when you're evaluating both your field service and bookkeeping options. Trust me, it'll save you major headaches down the road.

Conclusion¶

The change is real, and it's happening right now. Automated bookkeeping services aren't just changing how we handle numbers - they're fundamentally reshaping how smart business owners think about their time and energy.

Think about it: every hour you spend wrestling with spreadsheets or chasing down receipts is an hour you're not out there growing your business. The math is simple, but the impact is profound. When you save those 10-12 hours per week and cut errors by 85%, you're not just getting better books - you're getting your life back.

The peace of mind that comes with real-time financial clarity is something you can't put a price on. No more lying awake wondering if you can make payroll. No more scrambling at tax time. No more making important decisions based on gut feelings instead of solid data.

For field service businesses especially, this integration between operations and finances opens up incredible possibilities. When your scheduling system talks to your accounting platform, you suddenly see which jobs actually make money and which customers are worth your time. That's the kind of insight that transforms good businesses into great ones.

Here at ServiceBuilder, we've watched thousands of service businesses make this transition. The ones that accept automated bookkeeping services alongside modern scheduling and dispatch tools consistently outperform their competitors. They're faster, more profitable, and frankly, a lot less stressed.

The future is already here - it's just waiting for you to step into it. Modern service businesses need systems that work together seamlessly, not a bunch of disconnected tools that create more work than they solve.

Ready to see what happens when streamlined operations meet smart financial management? Let's show you how the right combination of scheduling and bookkeeping automation can transform your business. More info about our platform.