How to Automate Your Accounts Receivable and Actually Enjoy Billing

- Andrew Leger

Why Manual Billing Is Killing Your Cash Flow¶

An automated accounts receivable system is a software platform that handles your entire billing process - from invoice creation to payment collection - without manual work. Here's what it does:

Generates invoices automatically from your completed jobs

Sends payment reminders on schedule without you lifting a finger

Matches payments to invoices using AI and OCR technology

Tracks aging reports and overdue accounts in real-time

Integrates with banks to reconcile payments automatically

Provides dashboards showing cash flow and collection metrics

If you've ever felt like billing is sucking the life out of your service business, you're not alone. Research shows that businesses handling manual accounts receivable processes receive payment in 78 days on average, while those using high levels of automation get paid in just 55 days.

That 23-day difference isn't just numbers on a spreadsheet - it's real cash sitting in your customers' bank accounts instead of yours.

The worst part? Manual billing gets harder as you grow. More customers means more invoices, more follow-ups, more payment matching, and more time spent on tasks that don't move your business forward.

I'm Andrew Leger, and I've spent over 15 years building enterprise-grade systems that automate complex workflows. Through ServiceBuilder, I've seen how the right automated accounts receivable system can transform a service business from reactive billing chaos to proactive cash flow management.

Why Billing Feels Broken¶

Most service businesses are still running their billing like it's 1995. Paper invoices scattered across desks, spreadsheet chaos where one wrong formula breaks everything, and a billing process that feels more like archaeological excavation than modern business operations.

We've all been there: digging through email threads to find that one invoice, manually typing customer information for the hundredth time, or realizing you forgot to bill a job from three weeks ago. Studies show that up to 30% of a finance team's time gets wasted on avoidable rework - tasks that automation could eliminate entirely.

The Promise of Automation¶

Here's what changes when you implement an automated accounts receivable system: your billing becomes predictable, your cash flow becomes manageable, and your customers actually start enjoying the payment process.

Companies with accounts receivable automation report that 87% see improvements in overall process speed, while 75% report better customer experiences. When customers can pay easily through self-service portals and receive clear, professional invoices automatically, they're more likely to pay on time.

The real magic happens when automation frees your team from mind-numbing manual tasks. Instead of chasing down payments and fixing data entry errors, they can focus on growing relationships and actually moving your business forward.

What Is an Automated Accounts Receivable System?¶

Picture this: you finish a service call, and by the time you're back in your truck, the invoice is already generated, sent to your customer, and sitting in their inbox. No data entry, no manual calculations, no forgotten invoices gathering dust on your desk.

That's exactly what an automated accounts receivable system delivers. It's a cloud-based platform that handles your entire credit-to-cash workflow - from the moment you complete a job to when payment lands in your bank account. Think of it as your billing department's personal assistant who never sleeps, never makes mistakes, and never forgets to follow up.

The real magic happens in how everything connects. When your technician marks a job complete, the system immediately pulls all the details, calculates costs including any extra materials or overtime, generates a professional invoice, and delivers it to your customer. All without anyone touching a keyboard.

From Paper to Platform: The Evolution Toward an Automated Accounts Receivable System¶

Remember the old days of thick ledger books and carbon-copy invoices? Then came spreadsheets and email PDFs - better than ledger books, but still basically manual work dressed up in digital clothes.

Today's automated accounts receivable systems use artificial intelligence to match payments instantly, optical character recognition (OCR) to read and process documents in seconds, and machine learning to predict which customers might need extra attention. The evolution happened quickly because every service business faced the same headaches: late payments, data entry errors, and the constant stress of never knowing when money would show up.

Key Terminology You'll Hear Every Day¶

Days Sales Outstanding (DSO) is simply how long it takes to get paid after you finish a job - the lower the number, the better your cash flow. Your aging report breaks down unpaid invoices by how long they've been sitting there - 30 days, 60 days, 90+ days.

Cash application is the process of matching incoming payments to specific invoices. Modern systems handle this automatically using AI. The dunning cycle is your automated sequence of payment reminders that runs automatically, so you're not the bad guy constantly calling customers.

Compliance ensures your billing meets standards like tax regulations and industry requirements. Automation handles this behind the scenes, so you don't have to worry about staying up-to-date with changing rules.

Why Automate? Benefits You'll See in Weeks¶

The benefits of implementing an automated accounts receivable system aren't some distant promise - they're real improvements you'll notice within weeks of flipping the switch.

Cash flow becomes predictable for the first time in years. Instead of that familiar Sunday night panic wondering if you'll make payroll, you get crystal-clear visibility into what's owed, when it's due, and exactly what actions are happening to collect it.

Your team's productivity skyrockets because they finally stop doing robot work. No more hunching over keyboards typing the same customer information for the hundredth time. The research shows businesses save up to 30% of their finance team's time through automation.

Accuracy improves so dramatically it's almost embarrassing to think about how many errors you were making before. Human mistakes in manual billing simply disappear when systems pull data directly from source systems and use AI to match everything up.

Perhaps most surprisingly, your customer experience transforms from a source of frustration to something customers actually appreciate. When research shows that 75% of businesses report better customer experiences with AR automation, that's cause and effect.

Hard Numbers Behind the Hype¶

Companies implementing comprehensive AR automation achieve an average 250% ROI within six months. The payment timing difference is stark: businesses with high levels of automation receive payment in 55 days on average, compared to 78 days for manual processes. For a service business doing $1 million annually, that 23-day improvement represents roughly $63,000 in improved cash flow.

Finance teams report saving more than 10 hours per week on administrative tasks. Studies show automating invoicing can cut billing expenses by 49% when you factor in reduced paper costs, postage, storage, and labor costs.

Hidden Costs of Staying Manual¶

The real killer isn't obvious costs like paper and postage - it's the hidden costs slowly bleeding your business dry. Consider what happens when you send out a wrong invoice: someone identifies the mistake, researches what went wrong, corrects and resends it, explains to a confused customer, then waits for delayed payment. A single billing error can easily consume 2-3 hours of staff time plus delay payment by weeks.

Spreadsheet costs compound over time. What starts as a simple billing spreadsheet becomes a fragile house of cards that collapses when someone adds a column in the wrong place.

Manual AR Tasks You Can Retire¶

Here's your liberation list - the soul-crushing manual tasks that an automated accounts receivable system handles while you sleep:

Data entry from job completion forms - system pulls directly from your service platform

Invoice creation and formatting - happens automatically with professional branding

Payment reminder emails - scheduled and sent based on aging and customer preferences

Payment matching and reconciliation - AI handles this in seconds instead of 15-30 minutes per payment

Aging report generation and cash flow forecasting - update in real-time

Tax calculation and compliance - handled by built-in tax engines

Each task represents hours of manual work that simply vanishes when you automate. It's common to free up 15-20 hours per week of staff time.

Comparing Manual vs Automated AR Outcomes¶

Metric

Manual Process

Automated System

Invoice Processing Time

2-3 days per batch

Same day, automatic

Payment Reminder Frequency

Sporadic, when remembered

Scheduled, consistent

Payment Matching Time

15-30 minutes per payment

Seconds, automatic

Error Rate

3-5% of invoices

<0.1% with validation

Days Sales Outstanding

65-78 days average

45-55 days average

Staff Hours on AR Tasks

20-30 hours/week

5-8 hours/week

The difference isn't just operational - it's strategic. Manual processes keep you reactive, always scrambling to respond to problems. Automation makes you proactive, preventing problems before they arise.

How an Automated Accounts Receivable System Works: Features, Tech & Integrations¶

Picture this: A customer calls about their broken air conditioner. Your technician fixes it, marks the job complete on their phone, and within minutes, a professional invoice lands in the customer's email. They click a link, pay online, and the money hits your bank account while updating your books automatically. No one at your office touched the billing process.

That's a modern automated accounts receivable system at work. It combines artificial intelligence, robotic process automation, and optical character recognition to handle your entire billing workflow without human intervention.

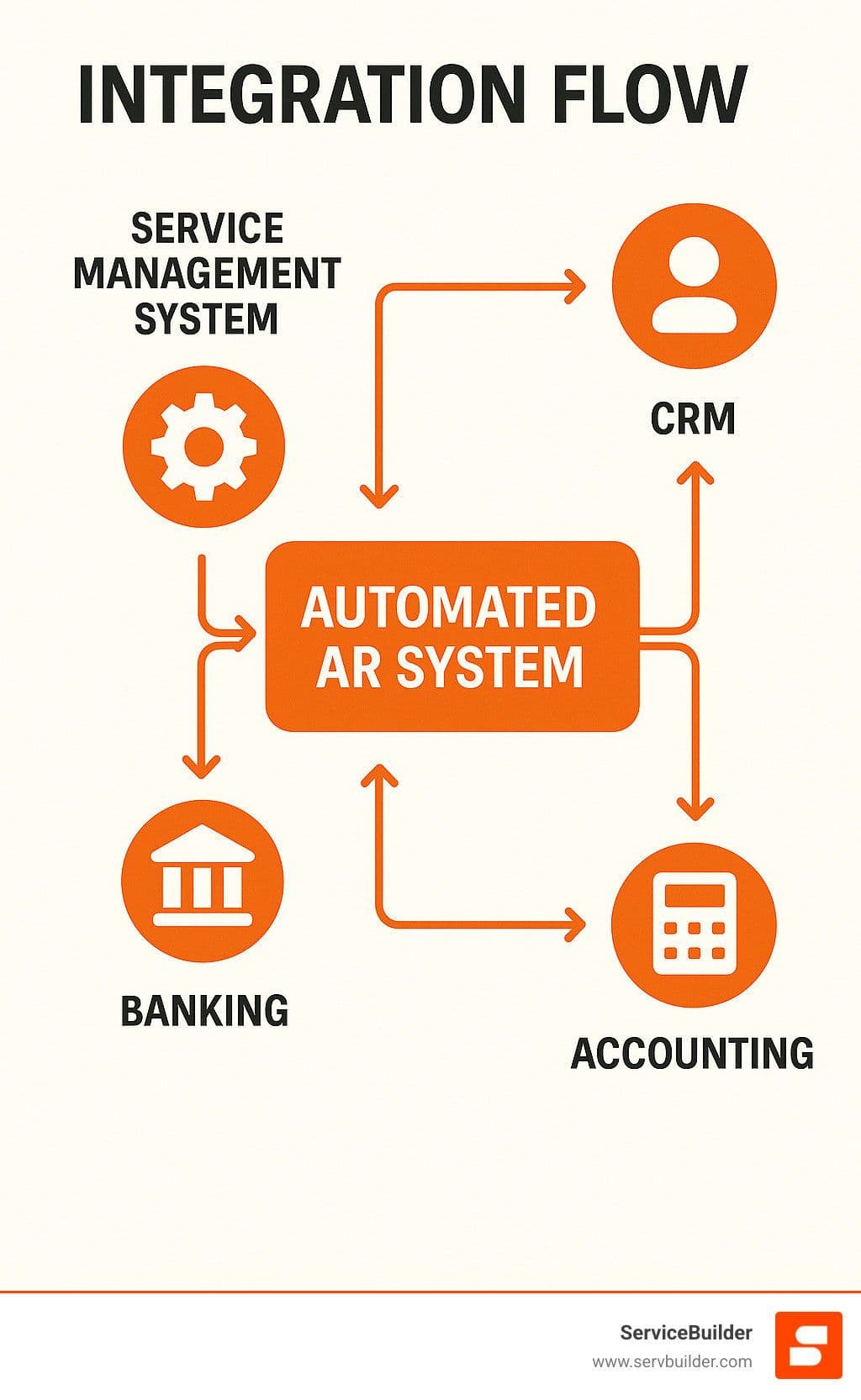

The magic happens through seamless integrations. Your service management platform talks to the AR system through APIs, sharing job details the moment work gets completed. The system generates invoices, delivers them, tracks whether customers opened them, automatically follows up, processes payments, and keeps your accounting system updated in real-time.

Core Features You Should Expect¶

Invoice generation and customization happens automatically when technicians complete jobs. The system pulls all relevant details and creates professional invoices with your branding. Good systems handle complex pricing structures, recurring services, and milestone billing.

Self-service customer portals transform the payment experience. Customers can view invoices, check payment history, pay online with multiple options, set up autopay, and download receipts without calling your office.

Automated payment reminders work like a polite, persistent assistant. The system sends gentle reminders at intervals you define, escalating appropriately over time while tracking customer preferences.

Intelligent cash application automatically matches payments to correct invoices using AI, even when customers pay partial amounts or forget invoice numbers. It gets smarter over time, learning payment patterns.

Real-time analytics and reporting give instant insight into cash flow health. Dashboards show key metrics like DSO, aging summaries, and collection effectiveness.

Under the Hood: AI & RPA in Action¶

Robotic Process Automation (RPA) handles repetitive tasks that drain your team's energy - generating invoices, sending reminders, updating records, posting transactions. It never gets tired, never makes typos, never forgets to follow up.

AI shines when decisions need to be made. When a payment comes in for $1,847.23 and you have invoices for $1,850.00 and $1,845.50, AI determines which invoice the customer intended to pay using timing, amount proximity, and historical patterns.

Predictive matching gets better with each transaction. Risk scoring helps you stay ahead of payment problems by analyzing payment history and external credit data.

Integrating With the Rest of Your Stack¶

Your service management platform should trigger the entire billing process automatically. When technicians mark jobs complete, all details flow directly into the AR system without manual data entry.

Banking integrations enable automatic payment reconciliation. When payments hit your bank account, the system immediately matches them to invoices and updates all records.

CRM synchronization keeps customer information current everywhere. Accounting system integration ensures your books stay current without manual journal entries.

Security, Privacy & Compliance Essentials¶

SOC 2 Type II compliance ensures the system meets strict security standards including encryption, regular audits, and comprehensive access controls. GDPR compliance provides data portability and deletion capabilities for European customers. HIPAA compliance matters if you serve healthcare clients.

Role-based access controls ensure team members only see relevant data. Audit trails track every action for compliance purposes, creating detailed records if regulators ever come knocking.

Implementation & Best Practices¶

Getting an automated accounts receivable system up and running isn't like installing a phone app. It's more like renovating your kitchen - you need a plan, the right team, and realistic expectations.

The businesses that succeed treat implementation as a change management project, not just a technology deployment. Stakeholder alignment comes first because everyone affected needs to understand what's happening and why.

Data cleanup sounds boring but it's absolutely critical. You can't automate chaos - you'll just get automated chaos, which is worse. This means standardizing customer names, cleaning up duplicates, and making sure your invoice numbering makes sense. Most businesses find their data is messier than they thought.

Change management determines whether your team accepts the new system or quietly sabotages it. Focus on how automation eliminates the tedious parts of their jobs - no more manual data entry, no more chasing payment information, no more building reports from scratch.

Choosing the Right Automated Accounts Receivable System¶

Feature fit matters more than feature count. Make two lists: features you absolutely must have, and features that would be nice to have. Don't get impressed by features you'll never use.

Scalability becomes crucial as your business grows. The system that handles 100 invoices per month beautifully might crash at 1,000 invoices per month. Ask vendors specific questions about volume limits and processing speed.

Usability determines whether your team actually uses the system. Look for intuitive interfaces, good mobile support, and training resources that don't require a computer science degree.

Support quality becomes your lifeline when things go wrong. Look for vendors offering multiple support channels, reasonable response times, and support staff who understand service businesses.

Step-by-Step Deployment Roadmap¶

Weeks 1-2: Planning - Document your current AR process and identify pain points. Define success metrics and create a realistic timeline.

Weeks 3-4: Selection - Evaluate vendors based on must-have features. Conduct demos with real scenarios and check references.

Weeks 5-8: Configuration - Clean and standardize customer data. Configure system settings and set up integrations. Test everything thoroughly.

Weeks 9-10: Training - Test with real data in a safe environment. Train your team and create documentation.

Weeks 11-12: Pilot - Go live with limited customers. Monitor performance and gather feedback.

Weeks 13-16: Full Rollout - Expand to all customers. Monitor metrics and fine-tune based on real-world performance.

Common Pitfalls & How to Avoid Them¶

Dirty data disasters cause more failures than any other factor. Invest time upfront cleaning customer records and eliminating duplicates.

Scope creep happens when you try to solve every problem at once. Get core functionality working first, then add complexity later.

User resistance emerges when people fear change. Address concerns directly and provide comprehensive training.

Future-Proofing Your Investment¶

Look for systems built on modern, modular architectures that adapt without requiring complete replacement. AI capabilities should improve over time through machine learning. Open APIs enable future integrations with tools you haven't found yet.

At ServiceBuilder, we're building the next generation of service business automation with these principles in mind. Why we're building ServiceBuilder reflects our commitment to solving real problems for service businesses.

Frequently Asked Questions about Automated Accounts Receivable Systems¶

How does automation reduce DSO?¶

The magic lies in eliminating gaps where money sits idle. Automation closes these gaps completely - invoices generate and deliver the moment jobs complete, payment reminders go out on schedule every time, and multiple payment options make it easy for customers to pay instantly.

Businesses using high levels of automation collect payments in 55 days on average, while manual processes take 78 days. That 23-day improvement is a 30% reduction in DSO that puts real cash in your bank account sooner.

Will automation eliminate my AR team?¶

Automation makes your AR team more valuable, not less necessary. Instead of spending days on data entry and routine payment matching, your team analyzes payment trends, builds customer relationships, and develops cash flow strategies.

Finance teams save up to 30% of their time through automation, but that time gets redirected toward strategic activities. Team members evolve from order-takers to strategic thinkers who actually move your business forward.

How do I measure ROI after go-live?¶

Start with baseline metrics before implementation: current DSO, hours spent on AR tasks weekly, error rates, and processing costs. After go-live, measure the same things plus new automation-enabled metrics like payment success rates and cash flow predictability.

Hard savings come from reduced labor costs and faster payment collection. If you're collecting payments 20 days faster, calculate what that improved cash flow is worth. Most service businesses see positive ROI within 3-6 months.

Conclusion¶

Your billing doesn't have to be the part of your business that keeps you up at night. An automated accounts receivable system transforms the entire experience - from the dreaded monthly invoice marathon to smooth, predictable cash flow that actually supports your growth plans.

Think about where you want your service business to be in two years. Do you want to still be wrestling with spreadsheets and chasing down payments? Or do you want to be the business owner who confidently makes decisions because you know exactly when money is coming in?

The research makes it clear: 87% of businesses see real process improvements when they automate their billing. More importantly, 75% report happier customers who actually enjoy paying their bills through professional, easy-to-use systems. And that 23-day improvement in payment timing isn't just a nice statistic - it's real cash in your bank account, available for payroll, equipment, and growth opportunities.

But here's what the numbers can't capture: the relief you'll feel when billing just works. No more panic when you realize you forgot to send invoices. No more awkward phone calls asking "did you get my invoice?" No more wondering if that payment was supposed to match the Johnson job or the Jackson job.

At ServiceBuilder, we understand that service businesses need more than generic billing software. We're building automated accounts receivable capabilities designed specifically for how service companies actually operate. Our platform respects your privacy, gives you early access to innovative features, and focuses on solving real problems instead of creating new ones.

The future of service business billing is surprisingly delightful when it's fully automated and intelligently designed. Your competitors are already finding the cash flow advantages of automation. The question is whether you'll join them now or wish you had started sooner.

Ready to transform your billing from your biggest headache to your secret competitive advantage? Contact our team for early access to ServiceBuilder's next-generation billing automation. Your future self - and your bank account - will thank you.