Software as a Service Business Model Demystified (No Tech Degree Required!)

- Andrew Leger

Why Understanding the Software as a Service Business Model Matters for Your Business¶

The software as a service business model is changing how companies buy, use, and pay for software. Instead of purchasing expensive programs upfront, businesses now subscribe to cloud-based tools they access through web browsers or mobile apps.

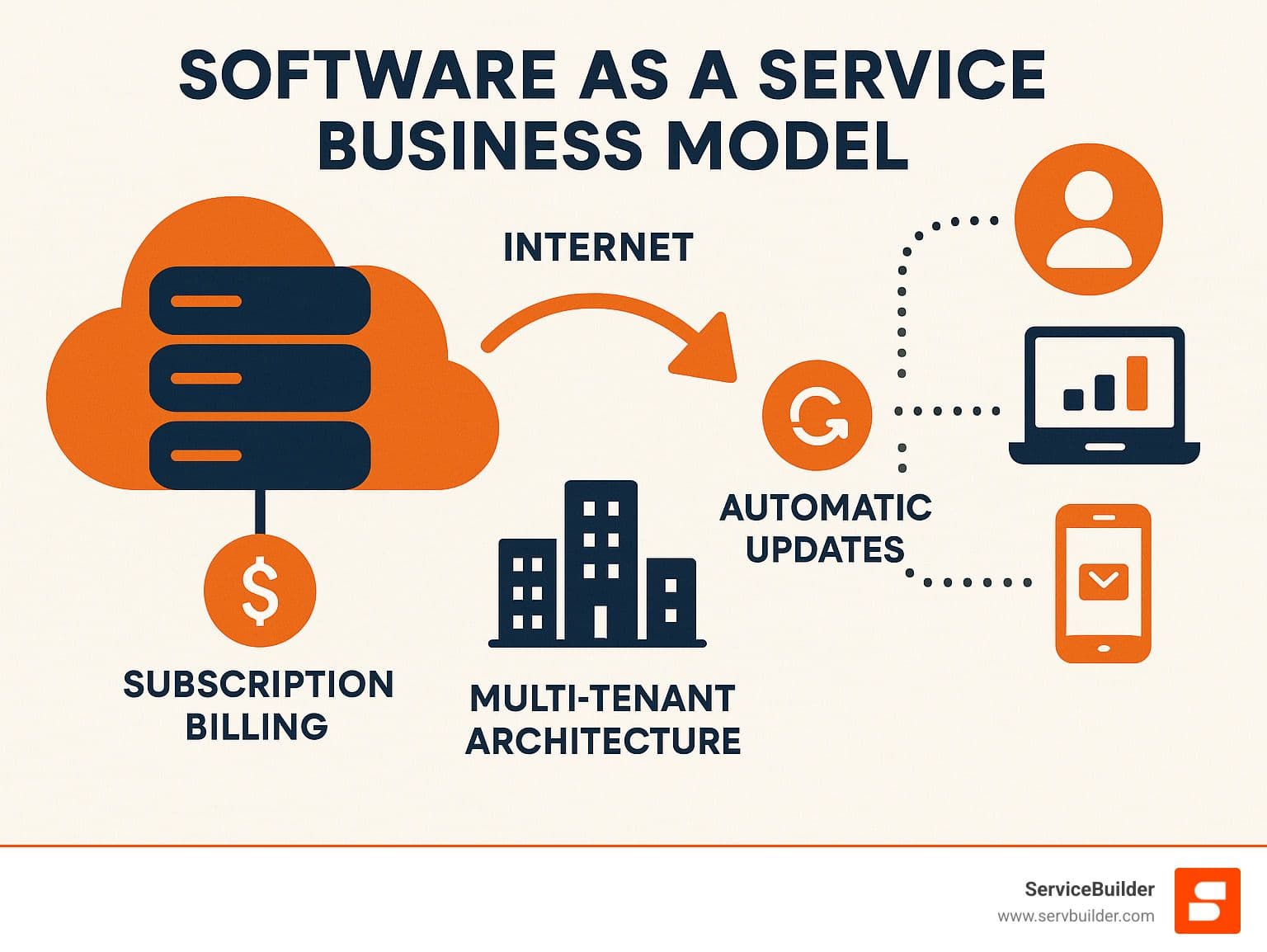

Key Components of the Software as a Service Business Model:

Subscription-based pricing - Pay monthly or yearly instead of large upfront costs

Cloud hosting - Software runs on the provider's servers, not your computers

Automatic updates - New features and security patches happen behind the scenes

Multi-tenant architecture - One software version serves thousands of customers efficiently

Internet delivery - Access from anywhere with an internet connection

The SaaS industry is projected to exceed $25 billion annually, with 43% of the cloud computing market now dominated by software-as-a-service solutions. By 2023, SaaS became the primary method companies use to deliver applications.

For field service businesses like HVAC, landscaping, or cleaning companies, this shift means lower startup costs, better mobile access, and always-updated tools without IT headaches. You get enterprise-grade software without enterprise-level complexity or price tags.

But understanding how SaaS companies actually make money, deliver value, and sustain growth helps you make smarter software decisions for your business. Whether you're evaluating new tools or curious about the business model powering your current apps, knowing these fundamentals protects you from costly mistakes.

I'm Andrew Leger, and I've spent over 15 years building enterprise software systems across healthcare, staffing, and logistics before creating ServiceBuilder, a modern SaaS platform for field service teams. My experience designing and scaling software as a service business model solutions taught me how these systems work from both the technical and business sides, which I'll break down in simple terms throughout this guide.

Understanding the Software as a Service Business Model¶

At its core, the software as a service business model transforms software from a product you buy once into a service you subscribe to continuously. Think of it like the difference between buying a car versus subscribing to a ride-sharing service - you get the benefits without the ownership headaches.

The model operates on four fundamental principles:

Recurring Revenue: Instead of large one-time payments, customers pay smaller monthly or annual fees. This creates predictable income streams for providers and manageable costs for users.

Cloud Hosting: Software runs on the provider's servers in data centers, not on your local computers. This eliminates installation, maintenance, and hardware requirements for customers.

Multi-tenancy: One software instance serves multiple customers simultaneously, like an apartment building where everyone shares infrastructure but has private spaces. This dramatically reduces costs per customer.

Continuous Delivery: Updates, security patches, and new features deploy automatically without customer intervention. Everyone always uses the latest version.

Origins & Evolution of the Software as a Service Business Model¶

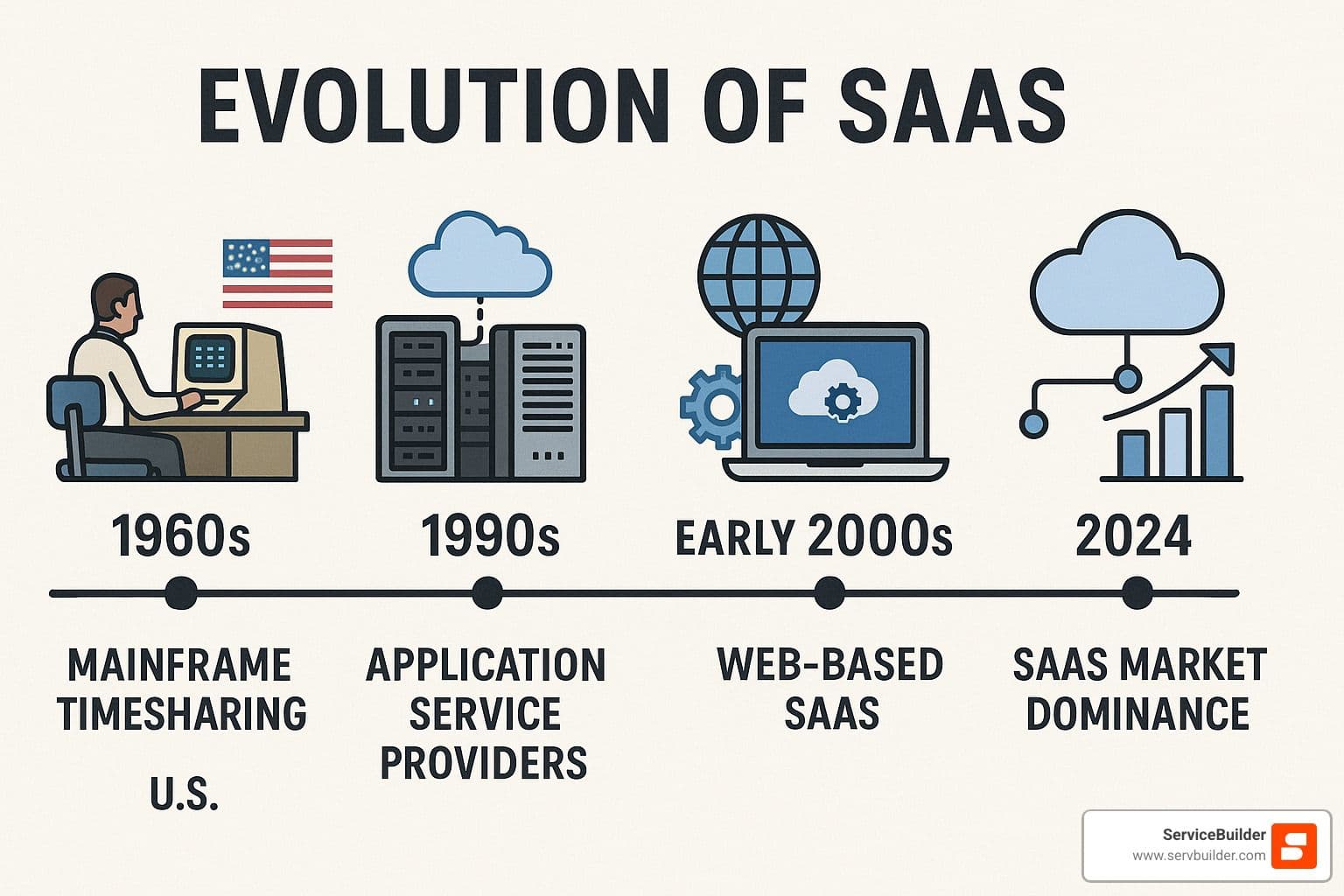

The software as a service business model didn't emerge overnight. Its roots trace back to the 1960s with mainframe timesharing, where multiple users accessed powerful computers remotely through terminals. This early concept of shared computing resources laid the groundwork for modern SaaS.

In the 1990s, Application Service Providers (ASPs) offered hosted software over private networks, but high costs and limited internet infrastructure prevented widespread adoption. The real breakthrough came with Web 2.0 technologies and broadband internet in the early 2000s.

Marc Benioff founded Salesforce in 1999, creating the first major SaaS company and proving the model could work at scale. By 2004, mass-market email services like Gmail demonstrated SaaS potential to consumers. The 2010s brought mobile-first SaaS solutions, and by 2023, SaaS had become the dominant software delivery method.

Key Pillars of the Software as a Service Business Model¶

Four pillars support every successful software as a service business model:

Centralized Ownership: The provider owns, maintains, and controls the software environment. Customers access functionality without owning the underlying technology, reducing their technical burden while giving providers complete control over the user experience.

Subscription Billing: Recurring payments create predictable revenue streams. Whether monthly, quarterly, or annual, subscription models align provider incentives with customer success - if customers don't get value, they cancel.

Browser/Mobile Access: Users access software through web browsers or mobile apps without installing anything locally. This eliminates compatibility issues, simplifies deployment, and enables access from any device with internet connectivity.

Automatic Updates: Providers push updates, security patches, and new features to all users simultaneously. This ensures everyone runs the latest version while eliminating the update burden for customers.

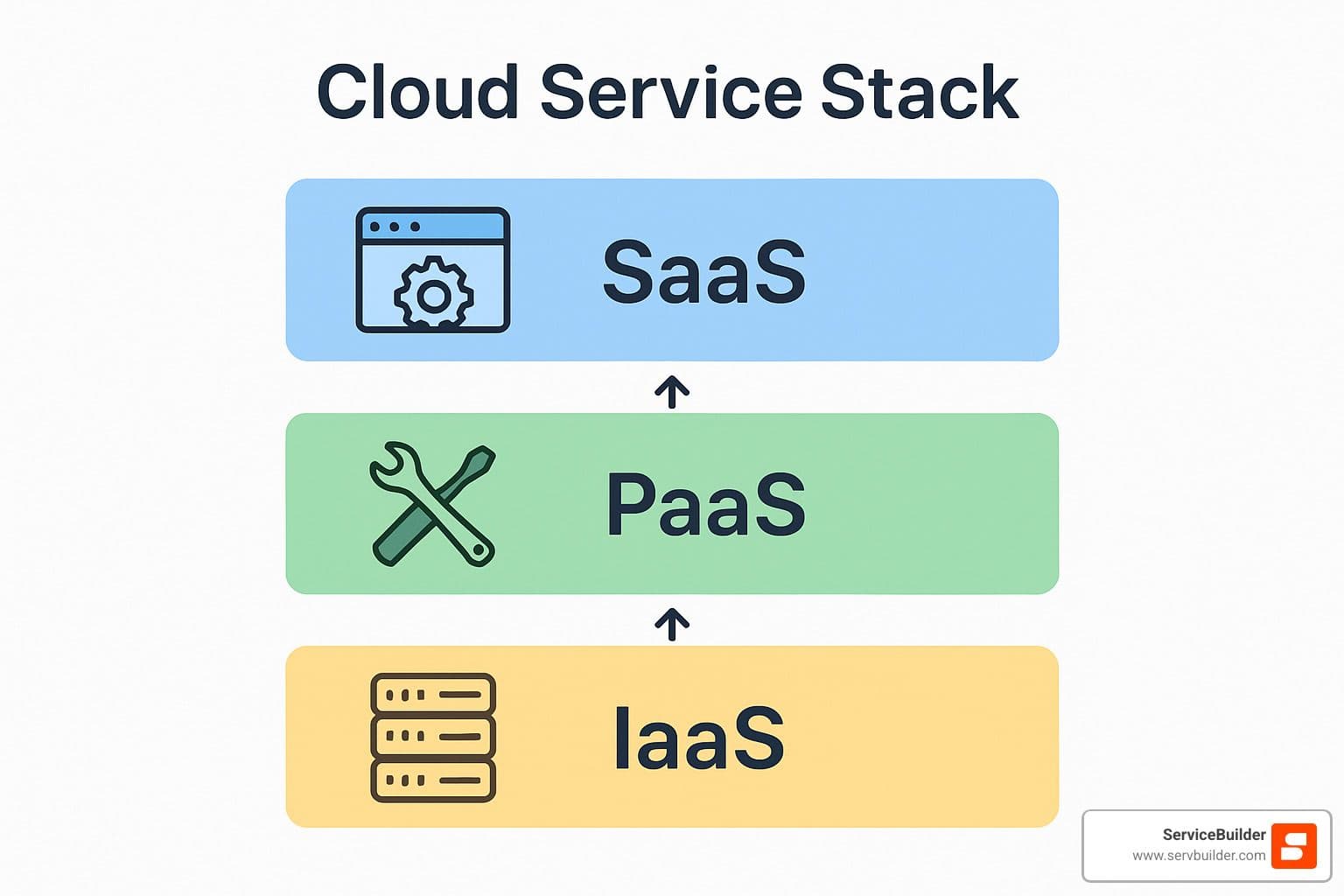

How SaaS Differs From Traditional Software & Other Cloud Models¶

Traditional software locked you into big upfront fees, local installation and never-ending manual updates. The software as a service business model flips that on its head: you pay predictable operating expenses, the provider runs everything in the cloud and improvements appear automatically.

Service Model

What You Get

What You Manage

Example

SaaS

Complete applications

Your data & settings

Gmail, Salesforce

PaaS

Development platform

Code you build

Heroku, AWS Lambda

IaaS

Virtual servers

OS & apps

AWS EC2, Azure VMs

Technical Underpinnings (Short Version)¶

Multi-tenant databases keep customer data separate while sharing infrastructure.

Microservices break large apps into smaller pieces for faster releases and easier scaling.

Auto-scaling adds or removes servers in real time so performance stays steady.

Security layers (encryption, access controls, audits) often exceed what small IT teams could build in-house.

Delivery & Updates in a Nutshell¶

Code moves through automated tests and staging, then rolls out with blue-green deployments or feature flags. If something misbehaves, providers hit rollback and users rarely notice. Everyone stays on the same version, so support teams solve problems once—not for dozens of outdated releases.

Revenue Engines: Subscription, Freemium & Beyond¶

The heartbeat of the software as a service business model is recurring revenue. Most companies start with straightforward per-user subscriptions, then layer on other options as they grow:

Subscription – flat monthly or annual fee for access.

Usage-based – pay only for what you consume (API calls, storage, texts sent).

Transactional – take a slice of each payment or booking processed.

Freemium – free core tier that converts power users to paid plans.

Metrics That Matter (Quick Guide)¶

MRR/ARR – recurring revenue totals.

Churn – percent of customers or dollars that cancel.

CAC – marketing + sales cost to win one new customer.

LTV – total revenue you’ll earn from a customer over time.

NRR – expansion revenue minus churn; >100 % is the goal.

If LTV:CAC is 3:1 or better and churn is low, the flywheel spins.

Growth Playbooks (Condensed)¶

Startup – hunt for product-market fit.

PMF Found – double-down on what users love.

Hyper-growth – raise capital, scale team, outrun competitors.

Mature – balance growth with profitability and retention.

Pros, Cons & Common Pitfalls for Providers and Customers¶

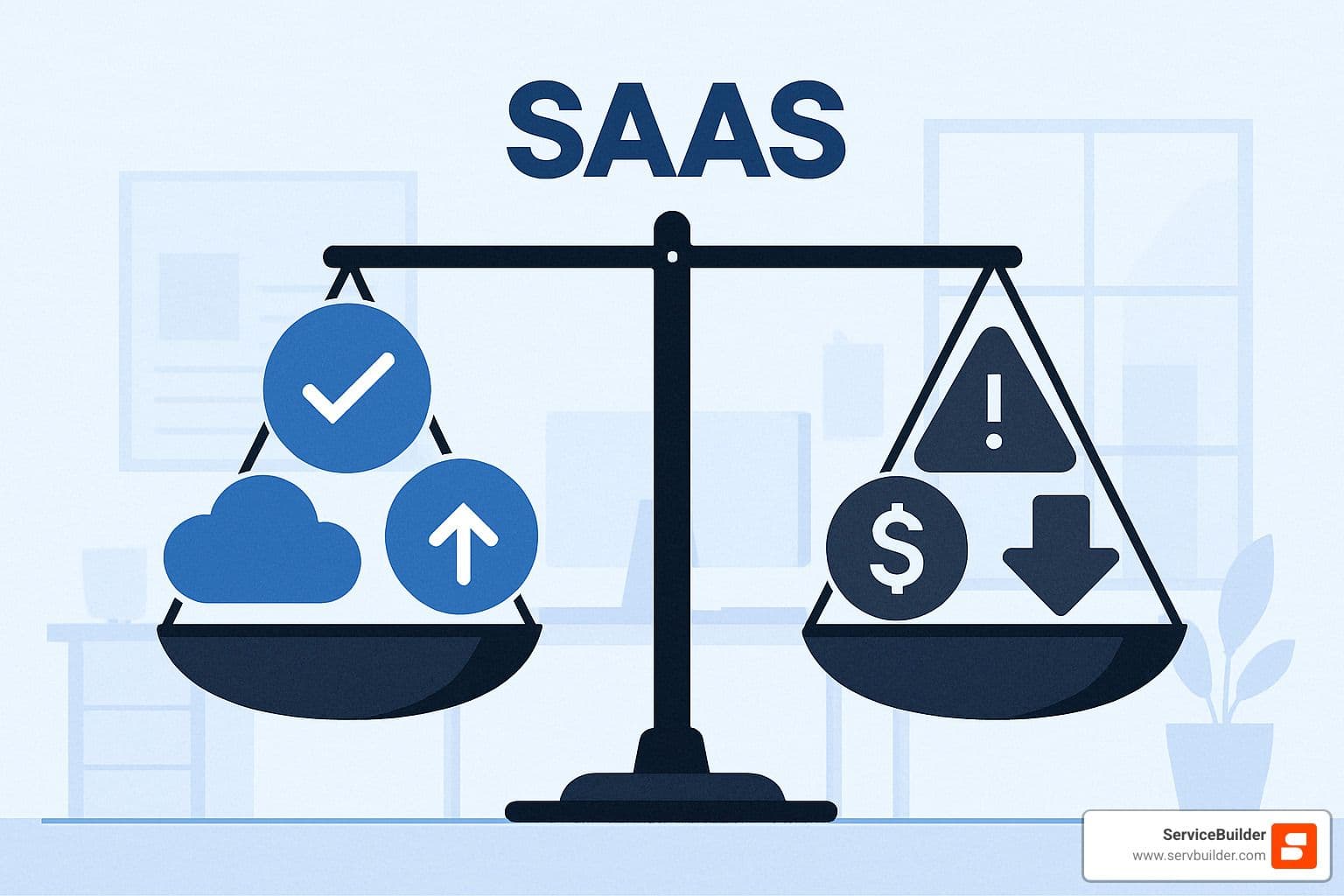

Why Customers Love SaaS

Start fast with low upfront cost.

No servers or upgrades to babysit.

Scale seats up or down in minutes.

Use the latest features automatically.

Why Providers Love SaaS

Predictable cash-flow from renewals.

Real-time usage data to guide product decisions.

One codebase to maintain instead of hundreds of versions.

Common Customer Concerns

Too many monthly subscriptions add up.

Work slows if the internet goes down.

Migrating data to a new vendor can be painful.

Provider Land-Mines

High churn can sink growth.

Compliance rules differ by state and industry.

Recessions push customers to cancel optional tools.

Mitigating Risk (Briefly)¶

Iron-clad SLAs spell out uptime and support commitments.

GDPR, SOC 2 and ISO-27001 certifications prove you take privacy seriously.

Regional data centers solve residency requirements.

Real-World Success Stories & Field-Service Case Study¶

Salesforce proved enterprise apps could live entirely in a browser, growing past $30 billion in revenue. Slack showed freemium and bottom-up adoption could topple email threads overnight. Each success followed the same rule: solve a painful problem better than legacy tools.

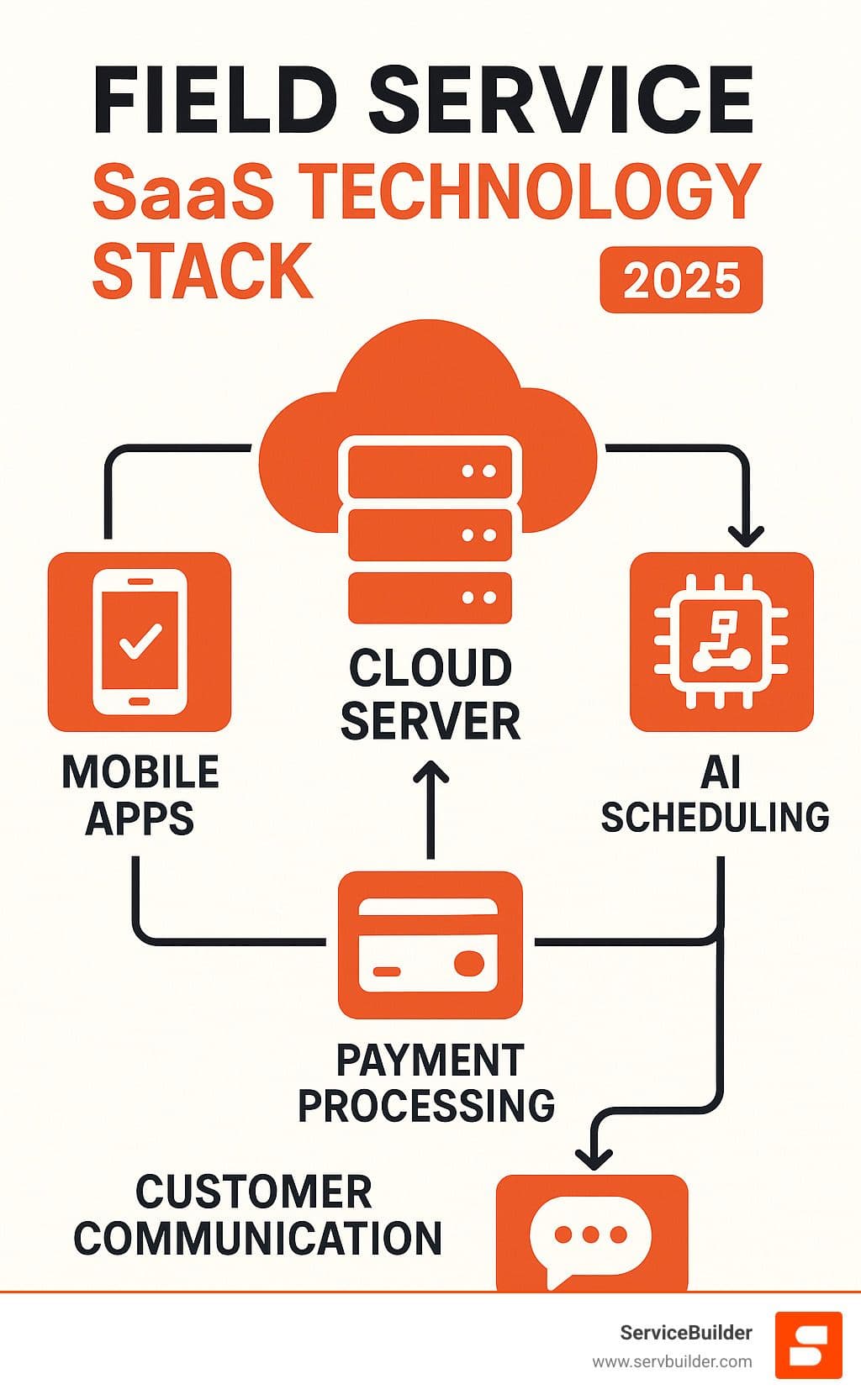

Field service teams have their own headaches—jobs change mid-day, cell coverage drops and hands get dirty. The software as a service business model finally gave these businesses real-time scheduling, offline-first mobile apps and instant customer updates.

ServiceBuilder leans into those needs with AI-assisted scheduling, privacy-first architecture and a clean mobile interface that works in basements, rooftops or backyards.

Frequently Asked Questions about the Software as a Service Business Model¶

How do SaaS companies roll out updates without disrupting users?¶

One of the biggest advantages of the software as a service business model is how seamlessly updates happen. You've probably experienced this yourself - you log into your favorite app one morning and notice a new feature or improved interface, without any downtime or installation hassles.

SaaS companies achieve this magic through sophisticated deployment strategies. The most common approach is called blue-green deployment, where providers maintain two identical production environments. While you're using the "blue" environment, they're updating the "green" one. Once everything tests perfectly, they flip a switch and suddenly everyone's using the updated version.

Feature flags make updates even smoother. Think of them as digital light switches that can turn specific features on or off without touching the core software. This lets companies roll out new capabilities to small groups of users first, gather feedback, and gradually expand access.

Database updates happen during quiet hours, usually late at night when fewer people are online. Companies carefully back up everything and have instant rollback plans ready. Most of the time, you'll never know an update happened - the software just works better the next day.

Can every business adopt a SaaS model, or are there limits?¶

The short answer is that most businesses can benefit from SaaS, but some are better suited than others. Let me break down what makes a business a good fit for cloud-based software.

Internet connectivity is the obvious requirement. If your business operates in areas with spotty internet, SaaS might be challenging. However, many modern SaaS apps work offline and sync when connectivity returns.

Software-dependent operations make natural SaaS candidates. If you're already using spreadsheets, desktop software, or paper-based systems, moving to SaaS often improves efficiency dramatically. Field service businesses fit perfectly here - they need mobile access, real-time updates, and tools that work in trucks and customer locations.

Data sensitivity used to be a bigger concern, but most SaaS providers now offer enterprise-grade security that exceeds what small businesses could implement themselves.

Budget preferences matter too. Companies that prefer predictable monthly expenses over large upfront investments love SaaS subscription models. Instead of buying $10,000 worth of software licenses, you might pay $100 monthly and get better features, support, and updates.

Field service businesses often represent the sweet spot for SaaS adoption. They need mobile access, don't want IT headaches, and benefit from features like GPS tracking, automated scheduling, and customer communication tools that work best in the cloud.

How is valuation calculated when selling a SaaS company?¶

SaaS company valuations work differently than traditional businesses, reflecting the unique characteristics of the software as a service business model. Instead of focusing primarily on profits, buyers look at recurring revenue and growth potential.

Annual Recurring Revenue (ARR) forms the foundation of most SaaS valuations. Buyers multiply ARR by various factors depending on the company's characteristics. A slow-growing SaaS business might sell for 2-3 times ARR, while a rapidly growing company could command 10-20 times ARR or more.

Several factors dramatically affect these multiples. Growth rate matters most - companies growing 50% annually get much higher valuations than those growing 10%. Customer churn tells buyers about product stickiness and market fit.

Gross margins reveal how efficiently the business operates. SaaS companies typically achieve 70-90% gross margins once they reach scale, much higher than traditional businesses.

Net Revenue Retention (NRR) has become increasingly important. Companies that grow revenue from existing customers faster than they lose revenue to churn demonstrate strong product-market fit.

Private SaaS companies typically sell for 3-8 times ARR, while public companies often trade at higher multiples. The exact multiple depends on all these factors plus market conditions and buyer competition.

Conclusion¶

The software as a service business model has taken software from a one-time purchase to a living, evolving service. For local HVAC, lawn care or cleaning companies, that means enterprise-grade tech without enterprise-grade headaches.

Looking ahead:

AI will schedule jobs, flag late payments and suggest upsells automatically.

Usage pricing will let small teams start cheap and pay more only as they grow.

Fewer apps, deeper integrations will replace today’s tool sprawl.

Ready to trade spreadsheets for software built for the field? See how ServiceBuilder can help when you’re juggling quotes, crews and customers on the go.