Automated Billing Platforms Explained (Because Manual Billing is So Last Year)

- Andrew Leger

Why Your Business Can't Afford Manual Billing Anymore¶

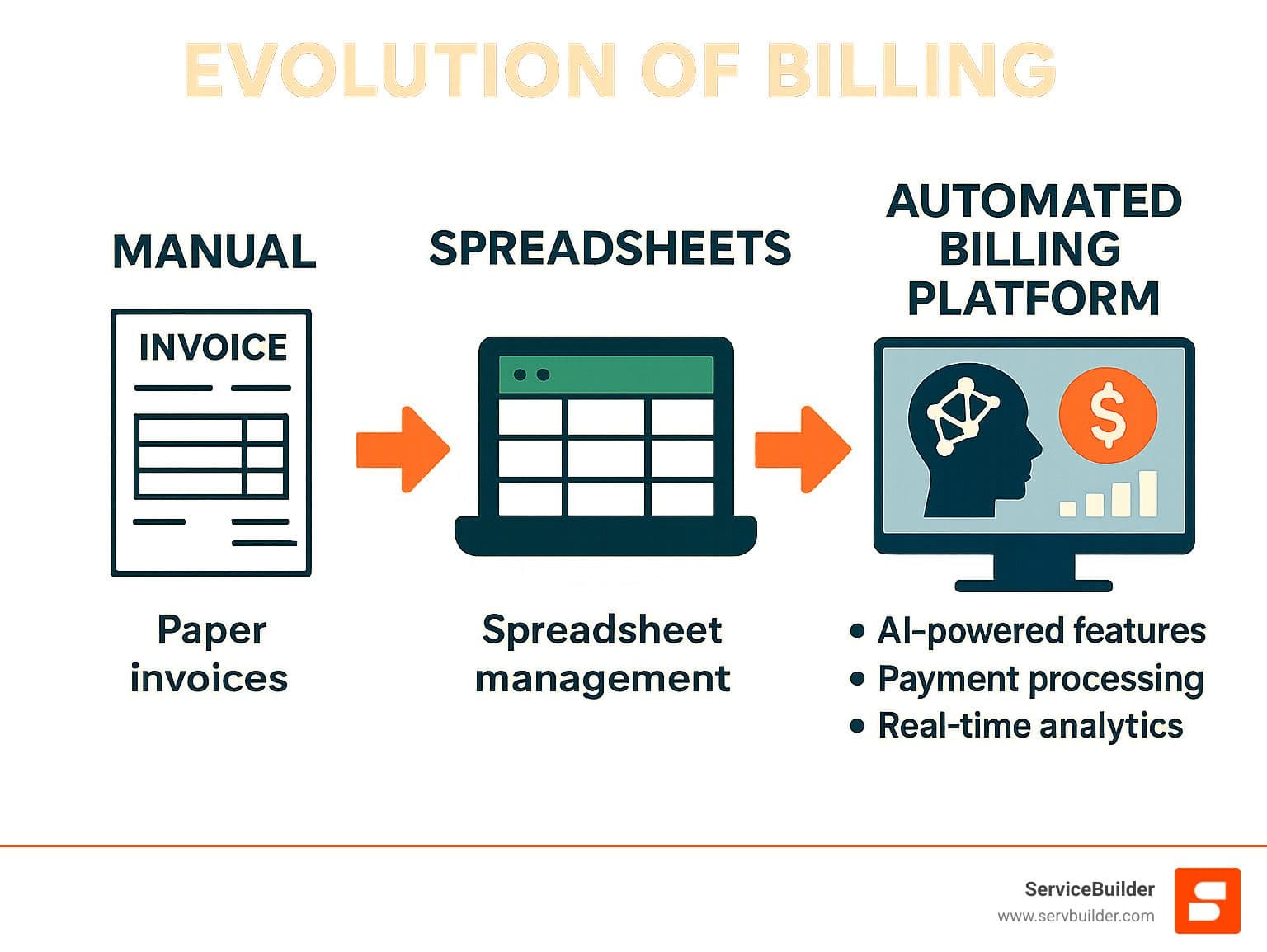

An automated billing platform is a software system that handles your entire billing process - from invoice creation to payment collection - without manual intervention. Here's what it does for your business:

Generates invoices automatically based on your service delivery or subscription schedules

Processes payments through multiple gateways (credit cards, ACH, digital wallets)

Sends payment reminders and handles collections workflows

Provides real-time reporting on cash flow, overdue accounts, and revenue trends

Integrates with your existing tools like CRM, accounting software, and field service platforms

Even a company with record-setting sales could struggle to pay its bills if its customers didn't pay their invoices on time - or at all. That's the harsh reality facing service businesses still stuck with manual billing processes.

Manual billing is killing your cash flow.

When you're juggling spreadsheets, chasing down payments, and spending hours on administrative tasks, you're not growing your business. You're just trying to survive it.

The numbers don't lie. Businesses using automated billing see an average of 250% ROI and 79% reduction in close time. Meanwhile, nearly 9 out of 10 accounting professionals report that automation makes their operations more profitable and efficient.

But here's the thing - switching to automated billing isn't just about saving time (though you'll save plenty). It's about changing how money flows through your business. No more chasing late payments. No more manual errors. No more cash flow gaps that keep you up at night.

I'm Andrew Leger, and after 15+ years building enterprise systems and leading dev teams, I've seen how the right automated billing platform can transform service businesses from reactive to proactive. At ServiceBuilder, we're building modern solutions that eliminate the billing bottlenecks holding field service companies back.

The Hidden Costs of Manual Billing¶

Here's what nobody tells you about manual billing: it's not just costing you time - it's quietly bleeding your business dry in ways you might not even notice.

Error rates with manual billing are shockingly high. Every time someone fat-fingers a number, sends an invoice to the wrong customer, or forgets to include that extra service charge, money walks out the door. These aren't just "oops" moments - they're revenue leakage that adds up to thousands of dollars over time.

Your Days Sales Outstanding (DSO) - basically how long it takes customers to actually pay you - stretches longer and longer with manual processes. When invoices get stuck in draft folders for days, payment reminders never get sent, and follow-up calls slip through the cracks, your cash flow takes a beating.

But here's the part that really hurts: staff burnout. Your talented team members didn't sign up to spend half their day wrestling with spreadsheets and chasing down payments. When they're buried in administrative busywork instead of growing your business, everyone loses.

Compliance risk is the sleeping giant that keeps smart business owners awake at night. Without proper audit trails, automated tax calculations, or consistent documentation, you're one audit away from serious trouble. An automated billing platform eliminates these risks by handling compliance requirements automatically.

Why Spreadsheets Don't Scale¶

Look, we get it. Spreadsheets feel safe and familiar when you're starting out. But they become your worst enemy as you grow. More info about spreadsheet pitfalls shows just how expensive this "free" solution really becomes.

Double-entry problems plague every spreadsheet-based billing system. You enter the same data in your service management system, then again in your billing spreadsheet, then once more in your accounting software. Each time you transfer information, you're rolling the dice on accuracy.

Version control becomes a nightmare when Sarah's working on last week's version while Mike's updating this week's copy. Which spreadsheet has the correct customer pricing? Did the new tax rates get applied everywhere? Good luck figuring that out.

The audit trail problem is even worse. When a customer disputes a charge or you need to investigate a billing error, you're left playing detective with incomplete clues. Who changed what? When did it happen? Your spreadsheet won't tell you.

Opportunity Cost of Late Cash Flow¶

Every dollar sitting in accounts receivable instead of your bank account is a missed opportunity. Working capital tied up in unpaid invoices means you can't hire that new technician, buy better equipment, or take on larger projects that could transform your business.

Growth stagnation happens when you're constantly firefighting billing issues instead of focusing on what matters. While your competitors are expanding their services and winning new customers, you're stuck in administrative quicksand, trying to figure out why last month's invoices still haven't gone out.

How an Automated Billing Platform Works¶

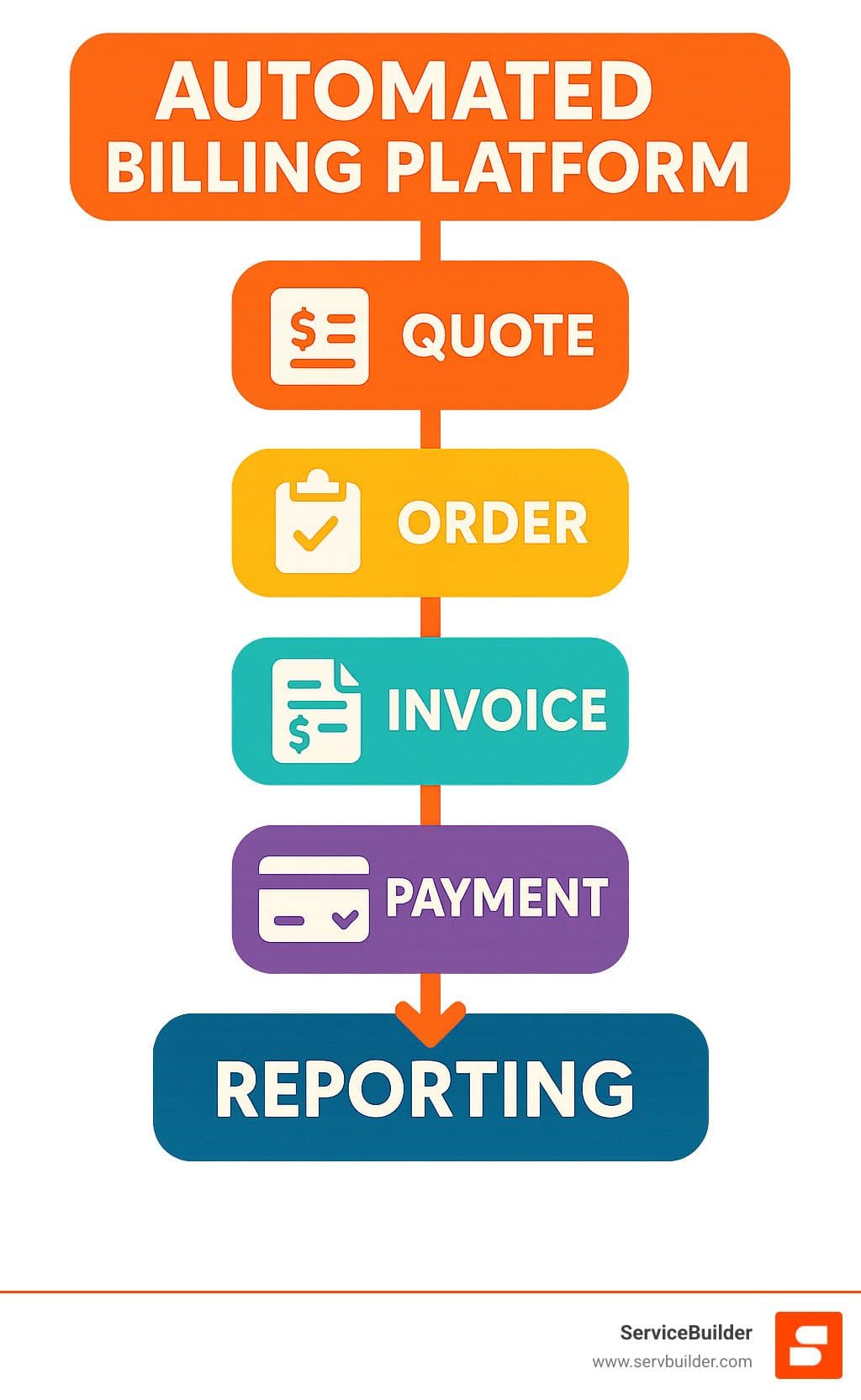

Think of an automated billing platform as your business's financial autopilot. While you're out serving customers and growing your company, it's quietly handling all the billing heavy lifting behind the scenes.

The magic starts with invoice generation. Instead of manually creating each invoice, the platform connects directly to your existing systems - your CRM, service management software, or time tracking tools. It pulls all the necessary information and creates perfect invoices automatically. No more late nights typing up invoices or worrying about forgotten line items.

Payment gateways are the unsung heroes of modern billing. Your customers want options - some prefer credit cards, others like ACH transfers, and younger customers might want digital wallets. The platform handles all the technical complexity, security requirements, and payment processing so your customers can pay however they want.

Here's where things get really smart: dunning workflows take over when payments are late. The system automatically sends gentle reminders, then more urgent ones, and even retries failed payments at optimal times. It only bothers you when human intervention is actually needed.

Real-time analytics give you a crystal-clear view of your financial health. Instead of wondering how your cash flow looks or which customers are behind on payments, you get instant insights. Cash flow forecasts, aging reports, and payment trends help you make smart decisions about your business.

The platform connects to your existing tools through APIs and integrations, creating a seamless flow of information across your entire operation. When everything talks to everything else, data stays consistent and nothing falls through the cracks.

AI insights are the cherry on top. The system learns from your payment patterns and customer behavior to optimize billing cycles, predict which customers might churn, and improve collection rates. It's like having a billing expert who never sleeps.

Data Flow Inside an Automated Billing Platform¶

Understanding how data moves through an automated billing platform is like seeing the gears of a well-oiled machine. Everything connects and flows smoothly.

CRM synchronization keeps your customer information rock-solid consistent. When Mrs. Johnson updates her email address or changes her credit card, that information flows automatically to every connected system. No more embarrassing moments when you send invoices to old email addresses.

Usage meters are perfect for field service businesses offering maintenance contracts or pay-per-use services. The platform tracks consumption in real-time and bills for actual usage without any manual calculations. Your customers pay for exactly what they use, and you capture every billable moment.

Tax engines handle the headache of tax calculations. Based on your customer's location, the type of service, and current tax regulations, the system calculates the right taxes automatically. No more late nights with tax tables or worrying about compliance issues.

The real power comes from flexibility. Modern platforms let you experiment with different business models without rebuilding your entire billing system. Want to try subscription pricing? Usage-based billing? The platform adapts to your business, not the other way around.

How an Automated Billing Platform Handles Recurring & Usage-Based Billing¶

Subscription cycles become completely effortless with automation. Whether you bill monthly for maintenance contracts, quarterly for service packages, or annually for comprehensive coverage, the platform handles all the scheduling. It even manages tricky situations like proration when customers upgrade mid-cycle.

Metered pricing gets calculated with perfect precision. The platform tracks every service call, every hour of maintenance, every part installed, then applies your pricing rules to generate accurate invoices. No more guessing or manual calculations that lead to revenue leakage.

Smart retries use artificial intelligence to recover more failed payments. Instead of blindly retrying a declined credit card every few days, the system learns the best times to retry based on payment patterns. Some platforms recover 11% more revenue just by timing retries better.

Customer portals give your customers control over their billing experience. They can update payment methods, download invoices, and manage their service subscriptions without calling your office. This reduces your support burden while making customers happier - a true win-win.

Must-Have Features & Tangible Benefits¶

Choosing the right automated billing platform isn't just about flashy features - it's about finding the tools that will actually transform your business. After working with countless service businesses, I've seen which capabilities make the real difference between struggling with cash flow and thriving.

Let's start with the heavy lifters. Batch invoicing is like having a superpower for your billing department. Instead of clicking through individual invoices for hours, you can generate hundreds of them with a single click. Imagine finishing your entire monthly billing run during your coffee break instead of spending your whole afternoon on it.

Multi-currency support becomes critical the moment you serve customers beyond your local market. The best platforms don't just convert currencies - they handle local payment methods, regional tax requirements, and even cultural preferences for invoice formatting. Your German customers get their invoices in euros with VAT properly calculated, while your Canadian clients see everything in CAD.

Here's where things get serious: security compliance with PCI DSS and GDPR standards. This isn't just a nice-to-have checkbox - it's what keeps you out of regulatory hot water. The right platform handles tokenization, encryption, and audit logging automatically, so you can sleep soundly knowing your customers' data is protected.

Reporting dashboards give you the financial visibility that manual processes simply can't match. The numbers tell the story: 66% of businesses prioritize cash flow forecasting, 56% closely monitor unapplied payments, and 51% track payment channel performance. When you can see these metrics in real-time instead of waiting for month-end reports, you can actually do something about problems before they become crises.

AI-powered recovery tools are where automation really shows its intelligence. These systems learn from payment patterns and customer behavior to optimize collection efforts. We're talking about recovering over $3.4 billion in revenue annually across all businesses using intelligent retry logic and personalized customer communications.

Scalability might seem like a future problem, but it's actually today's opportunity. The right platform grows with your business seamlessly, handling increasing transaction volumes without slowing down or breaking down.

Manual Billing

Automated Billing Platform

3-5 days invoice processing

Same-day invoice generation

15-20% error rates

Less than 1% error rates

45+ days average DSO

25-30 days average DSO

Hours of manual collections

Automated dunning workflows

Limited payment options

Multiple payment gateways

Basic reporting

Real-time analytics & AI insights

Boosting Cash Flow & Reducing Errors¶

The financial change from automation isn't just impressive - it's measurable down to the dollar. DSO reduction happens almost automatically when your invoices go out on schedule, payment reminders are consistent, and collections processes run like clockwork instead of depending on someone remembering to make calls.

Sage Intacct customers see an average 250% ROI within their first year of implementation. That's not a typo - they're making back two and a half times their investment in just twelve months. The 79% reduction in close time means you're not just getting paid faster, you're making business decisions with current data instead of last month's guesswork.

Error reduction might be even more valuable than time savings. When automated systems eliminate calculation mistakes, ensure consistent tax applications, and maintain accurate customer records, you're not just avoiding embarrassing billing errors. You're preventing disputes, speeding up payments, and building stronger customer relationships.

Think about it this way: every billing error costs you time to fix, damages customer trust, and delays payment. Multiply that across hundreds of invoices, and manual errors become a significant drag on your business.

Security, Compliance & Peace of Mind¶

Security isn't just about protecting data - it's about protecting your business reputation and avoiding devastating compliance penalties. Tokenization replaces sensitive payment information with secure tokens, dramatically reducing your PCI compliance burden while maintaining rock-solid security.

Encryption works behind the scenes to protect data whether it's moving between systems or stored in databases. All customer information, payment details, and transaction records get encrypted using industry-standard protocols that would make government agencies proud.

Audit logs create the detailed paper trail that manual systems simply can't provide. You can see exactly who accessed what information, when changes were made, and what approvals were required. When a customer disputes a charge or you need to investigate a billing discrepancy, you have complete visibility instead of playing detective with incomplete clues.

This level of security and compliance isn't just about avoiding problems - it's about building the kind of professional operation that customers trust with their business and their money.

Picking & Implementing Your Automated Billing Platform¶

Choosing the right automated billing platform feels overwhelming when you're staring at dozens of options, each promising to solve all your problems. The truth is, not every platform fits every business - and that's okay. The key is finding the one that matches how you actually operate.

Start by creating a requirements matrix that maps your business model to specific features. If you run recurring maintenance contracts, subscription billing capabilities are non-negotiable. But if you're primarily project-based, you need robust time tracking integration and flexible invoicing options instead. Don't pay for features you'll never use.

Your integration checklist should focus on the systems that already run your business. Can the billing platform talk to your existing accounting software without creating duplicate entries? Does it sync with your CRM so customer information stays current? These connections matter more than fancy features you might use someday.

Change management often gets overlooked until implementation day arrives and your team panics about learning new systems. Start talking to your staff early about what's changing and why. The person who's been managing invoices in spreadsheets for five years might need extra support - and their input during selection could save you headaches later.

User training requirements vary wildly between platforms. Some are intuitive enough that your team can figure them out over lunch. Others require formal training sessions and ongoing support. Factor this into your decision - a slightly more expensive platform that your team can actually use beats a cheap one that sits unused.

When you're ready to get serious, a vendor RFP process helps you compare apples to apples. Include real scenarios from your business in your requests. Ask vendors to show you exactly how they'd handle your most complex billing situation, not just the standard demo.

For service businesses specifically, billing doesn't happen in isolation. More info about choosing FSM software explains how integrated solutions can eliminate the gaps between service delivery and payment collection.

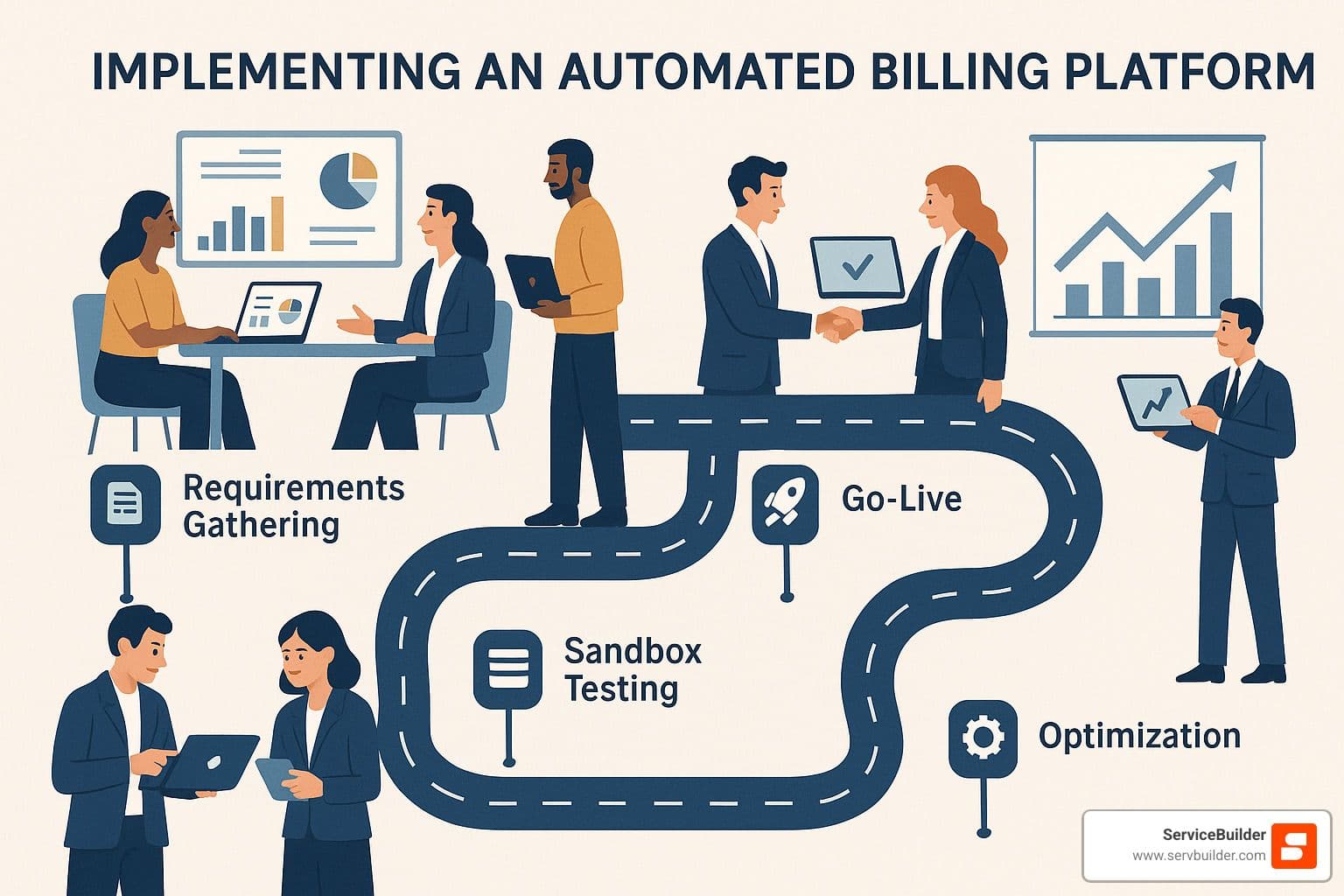

Step-by-Step Deployment Plan¶

Data migration is where most implementations get messy. Your customer records probably aren't as clean as you think they are. Duplicate entries, outdated contact information, and inconsistent product naming will all surface during migration. Plan extra time for data cleanup - it's not glamorous work, but it's essential for a smooth launch.

Sandbox testing gives you a safe space to break things before they matter. Test your weirdest billing scenarios first - the customer who gets a 15% discount on Tuesdays, the contract with unusual payment terms, the recurring service that bills quarterly but invoices monthly. If the platform handles your edge cases, the routine stuff will be easy.

Go-live support from your vendor can make or break your first month. Make sure you have dedicated support resources available during your first few billing cycles. Issues that seem catastrophic at 4 PM on a Friday become manageable when you know help is a phone call away.

Most implementations take between two and eight weeks, depending on how complex your current setup is. Simple businesses with straightforward billing can be up and running quickly. Complex operations with multiple integrations need more planning and testing time.

Integrations That Matter¶

Accounting software integration eliminates the double-entry nightmare that plagues manual processes. Your invoices should flow directly into QuickBooks, Xero, or Sage without anyone touching a keyboard. When payments come in, they should automatically match to the right invoices and update your books.

CRM platforms provide the customer intelligence that makes billing personal and accurate. When someone updates their email address or payment method in your CRM, that change should propagate to your billing system automatically. No more invoices bouncing back from old email addresses.

ERP systems handle the complex business logic that enterprise-level service companies need. If you're managing multiple locations, complex approval workflows, or detailed cost accounting, ERP integration becomes essential.

Field service tools create the bridge between work completion and payment. When your technician marks a job complete in the field, that should trigger the billing process automatically. No more waiting for paperwork to make its way back to the office before invoices can go out.

The best integrations feel invisible - data flows where it needs to go without anyone thinking about it. That's when you know you've found the right automated billing platform for your business.

Frequently Asked Questions about Automated Billing¶

You probably have questions about whether an automated billing platform is right for your business. That's normal - switching from familiar (even if frustrating) manual processes to automation feels like a big step. Let me address the concerns I hear most often.

What industries benefit most?¶

Here's the thing - almost every service business benefits from automated billing, but some industries see dramatic improvements because of their unique challenges.

Telecommunications companies are probably the poster child for billing automation. When you're managing millions of customers with different plans, usage patterns, and payment schedules, there's simply no way to do it manually. These companies literally couldn't exist without automated systems.

SaaS businesses live and breathe by subscription billing. Their entire revenue model depends on predictable, recurring payments. An automated billing platform handles plan upgrades, downgrades, prorations, and usage-based add-ons without breaking a sweat. Manual billing would kill their growth.

Utilities face similar complexity with consumption-based billing. Smart meters generate massive amounts of data that needs to be processed through complex rate structures. Automation ensures accurate calculations and consistent billing cycles.

Healthcare organizations deal with some of the most complex billing scenarios imaginable. Insurance claims, patient payments, regulatory compliance - it's a nightmare to manage manually. Automation reduces errors and keeps everything compliant.

Field service businesses (like many of ServiceBuilder's customers) benefit enormously from automated billing that kicks in the moment work is completed. No more waiting for someone to create invoices manually. Cash flow improves immediately.

How does it support global currencies & taxes?¶

Global billing used to be a major headache, but modern automated platforms handle it seamlessly.

Multi-currency support means your customers can pay in their local currency while you receive payment in yours. The platform handles real-time exchange rate updates automatically. No more manual currency conversions or outdated exchange rates.

VAT and GST calculations happen automatically based on where your customer is located and what type of service you're providing. The platform stays updated with changing tax regulations, so you don't have to worry about compliance issues.

Exchange rate management gives you flexibility in how you handle currency fluctuations. You can fix rates at invoice time for predictability, or use current rates at payment time for accuracy. It's your choice.

The best part? You set these rules once, and the system handles everything automatically. No more researching tax rates or calculating currency conversions manually.

Can it really prevent late payments?¶

This is probably the question I get asked most, and I understand why. Late payments are the bane of every service business owner's existence.

Automated reminders are game-changers because they're consistent and never forget. The system sends email, SMS, or even phone call reminders based on your customer's preferences and payment history. No more sticky notes or forgotten follow-ups.

Smart retries for failed payments use machine learning to figure out the best time to retry. Instead of blindly trying again in 24 hours, the system analyzes payment patterns to maximize recovery rates. This approach recovers significantly more revenue than old-school fixed-schedule retries.

Dunning rules can be customized based on your customer relationships. Your biggest clients might get a gentle phone call, while smaller accounts follow standard email sequences. The platform handles both automatically.

The reality is that most late payments aren't intentional - they're the result of forgotten due dates, expired credit cards, or simple oversight. Automated systems catch these issues before they become problems, which is why they're so effective at preventing late payments in the first place.

Conclusion¶

Here's the truth about billing in today's service economy: manual processes aren't just inefficient anymore - they're business killers. While that trusty spreadsheet might have served you well in the early days, it's now the anchor dragging down your growth potential.

The businesses thriving in today's market have one thing in common - they've acceptd automated billing platforms that handle the administrative grunt work while they focus on serving customers. They're not smarter than you. They just stopped fighting battles they didn't need to fight.

Future-proof billing isn't about fancy features or impressive dashboards. It's about choosing systems that adapt when your business model evolves, when new payment methods emerge, or when regulations change. The best platforms don't just solve today's problems - they prevent tomorrow's headaches.

At ServiceBuilder, we've watched too many talented service businesses get bogged down by billing bottlenecks. That's exactly why we're building solutions that eliminate these friction points entirely. We believe your energy should go toward growing your business, not wrestling with invoices and payment reminders.

Early access to our upcoming platform is available for service businesses ready to leave manual billing behind. We're committed to respecting your privacy while providing tools that actually make your life easier - not more complicated.

The math is simple: every day you stick with manual billing is another day of lost efficiency, frustrated team members, and slower cash flow. Your competitors who've already made the switch? They're using that extra time and money to capture market share while you're still updating spreadsheets.

The choice isn't really about whether you can afford to automate your billing. It's about whether you can afford to keep doing things the hard way while everyone else moves forward.

Ready to turn your billing from a time-sucking nightmare into a smooth-running machine? More info about our vision shows how we're building the future of field service management - and billing is just the beginning.

The manual billing era is ending. Your automated future starts now.